Summary

- Digital agendas have become increasingly central to national policies and plans that aim to respond to the challenges of the future.

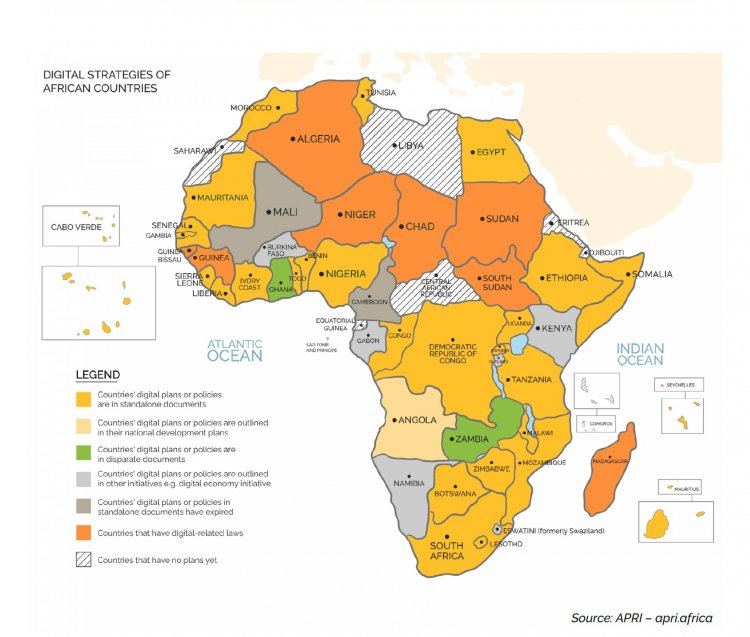

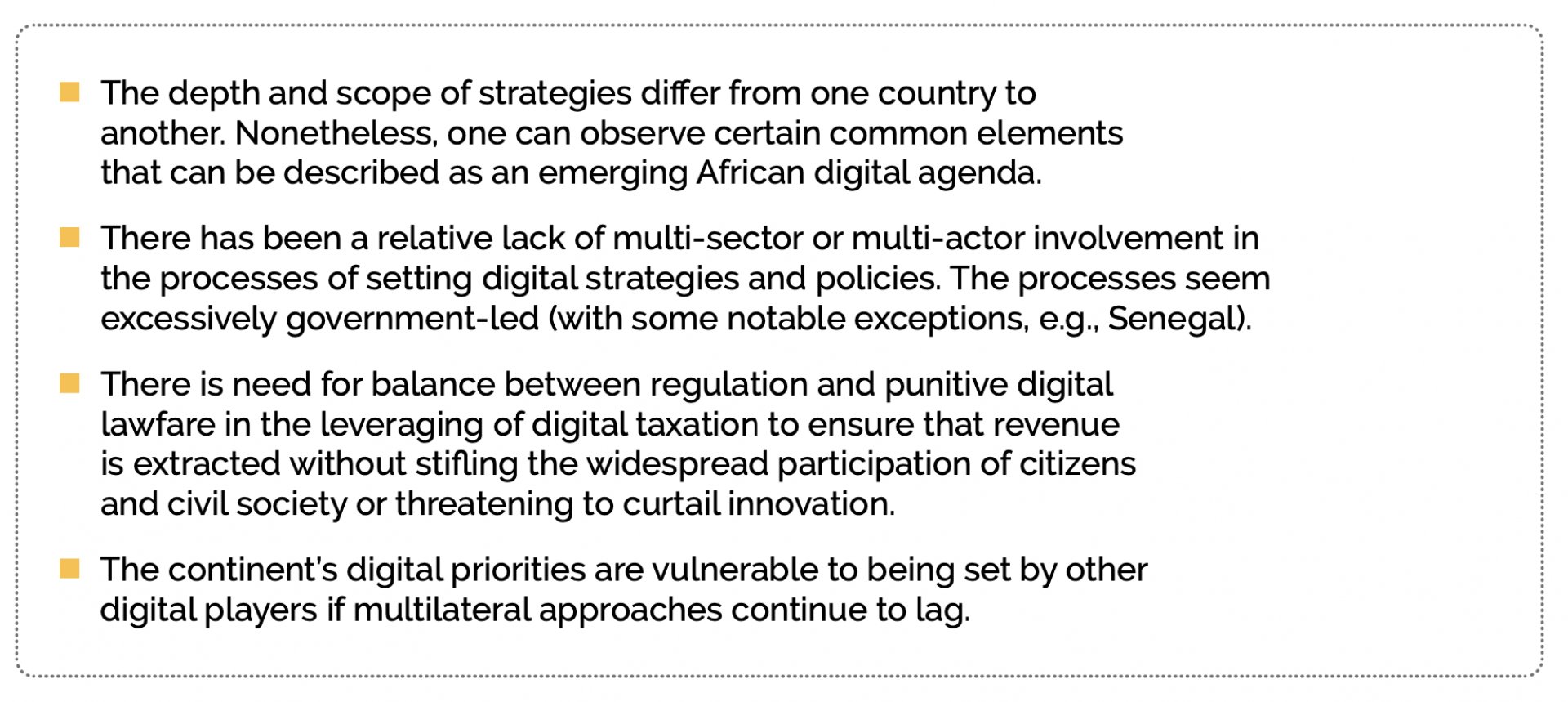

- Our review of African countries’ policies and strategies, the most comprehensive of its kind, demonstrates that most African countries have digital agenda documents. These are found as legal texts, stand-alone digital strategies, as sections of national development plans or within aspects of other policies.

- Most of these plans concern utilizing digital technologies for economic development through initiatives such as the (re)skilling of populaces. They also include harnessing more efficient service deliveries, and seizing opportunities for e-government that digital technologies provide. Several countries also have cybersecurity strategies. Considered collectively, all of these indicate an emerging African digital agenda

- Africa’s digital landscape has numerous stakeholders both internally and externally. While China has emerged as a major provider of Africa’s digital infrastructure, the European Union maintains considerable leverage in shaping the continents digital regulatory framework through being its largest overall donor.

- It is important to ensure that external partnerships are modulated to African contexts in an Africa-led process – including involving African representatives from the private sector as well as non-state actors.

- It is of equal importance to ensure that policies and strategies are not indiscriminately copied from other contexts. National and regional policymakers should exercise creativity and judgement that reflect the specificities of African contexts in formulating their digital policies.

Introduction

Digital technologies have been at the core of the rapid transformation in global geopolitics and economics. Owing to this, many countries have identified their digital agenda. In this paper, we define digital agenda as the collection of objectives and methods by which countries seek to make use of technologies across various sectors. Ideally, such agenda correlates with their economic realities, national politics, and the relationships they have with other countries.

With respect to different national agendas and investments in digital technologies, there are countries that seek to homogenize how technology is created, marketed, distributed, and used. Blocs like the European Union have expressed equal interest in setting the agenda for global digital technologies by shaping the digital agendas of their partners as an extension of their foreign policy.

African countries, however, are in another category. While they may lack political leverage or possess economies of a scale that could support ambitions to dominate and direct the world’s use of digital technologies, they are integrally important to the global digital ecosystem. Aware of the roles that they play as consumers of technologies, contributors to the training of Artificial Intelligence algorithms (albeit not always consensually) and as suppliers of the minerals vital to the production of digital infrastructures, African countries have not been passive in the politics of the digital ecosystem.

During the Trump administration in the US for instance, many African countries ignored US pressure by pursuing stronger digital ties with China and remained open to Russian interests. Today, up to 70% of the 4G base stations in Africa are constructed by the Chinese company Huawei. This is in addition to the involvement of other Chinese companies in constructing fiber optics across Africa.

As Africa begins to integrate more deeply through the African Continental Free Trade Agreement (AfCFTA), where negotiations around e-commerce protocol are imminent, we seek to answer a few questions in this paper: What emerges as Africa's digital agenda when one reviews the agendas of individual African countries? What kind of interactions have African countries been having with other global players in the digital ecosystem? What could be done to ensure that external players partner effectively with the continent to ensure that its digital potentials are realized for the benefit of all Africans?

This brief considers these questions with a focus on Africa’s interactions and partnerships on digital issues with the EU, its largest development partner. The EU currently provides about EUR20 billion (USD23.6 billion) per year in official development assistance by funding several initiatives in Africa’s technological sector. Most recently, it earmarked EUR82.5 million (USD97.2 million) to support six projects that include the use of digital technologies and space applications.

We first examine what digital agendas currently exist from both national and continental perspectives before considering which key policy areas emerge as central to the agendas. We then review how the EU has approached cooperating with Africa on digital issues. Our policy recommendations emphasize the advantages of a continent-wide approach to digital strategy that would ensure a home-grown, African digital agenda – and better position Africa for partnerships with international players .

Digital agendas, policies, and plans of African countries

Only a handful of African countries do not have some form of digital policy or strategy in place. Many outline their digital agendas in their national development plans. Others have dedicated documents that outline their digital agendas in greater detail. Others still have policies and strategic plans covering very specific items such as e-commerce, cybersecurity, digital privacy, and e-government. Egypt is distinct in being the only African country with a national strategy on artificial intelligence.

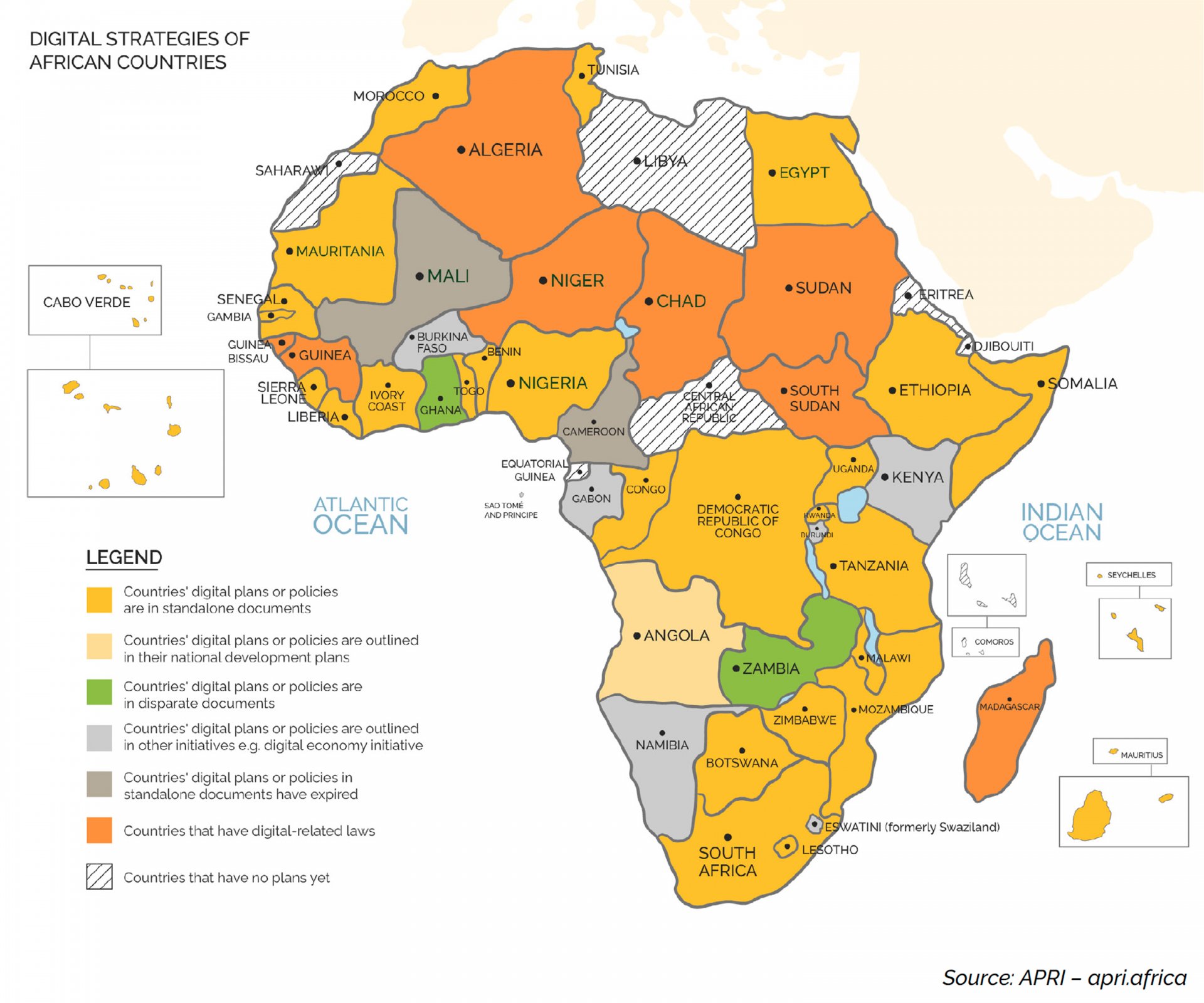

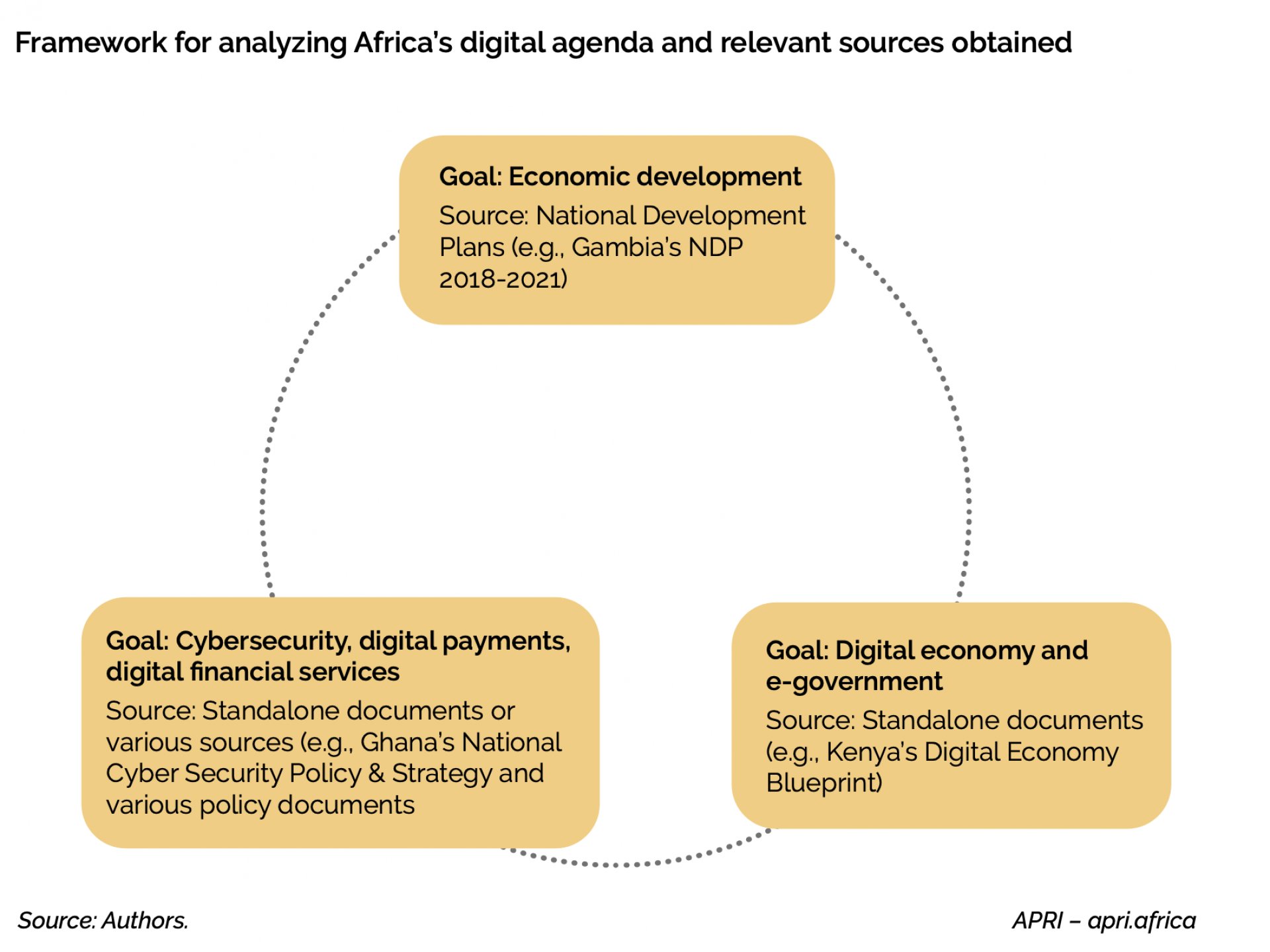

In this section, we discuss the content of some of the existing strategic plans, policies, and initiatives as outlined in standalone documents or within national development plans of selected African countries. The standing of the countries in the World Economic Forum’s Global Competitiveness Index is presented in the table below.

Digital agenda as presented in digital strategic plans

Here we consider the digital strategies of Mauritius, Egypt, Kenya, and Senegal.

Mauritius

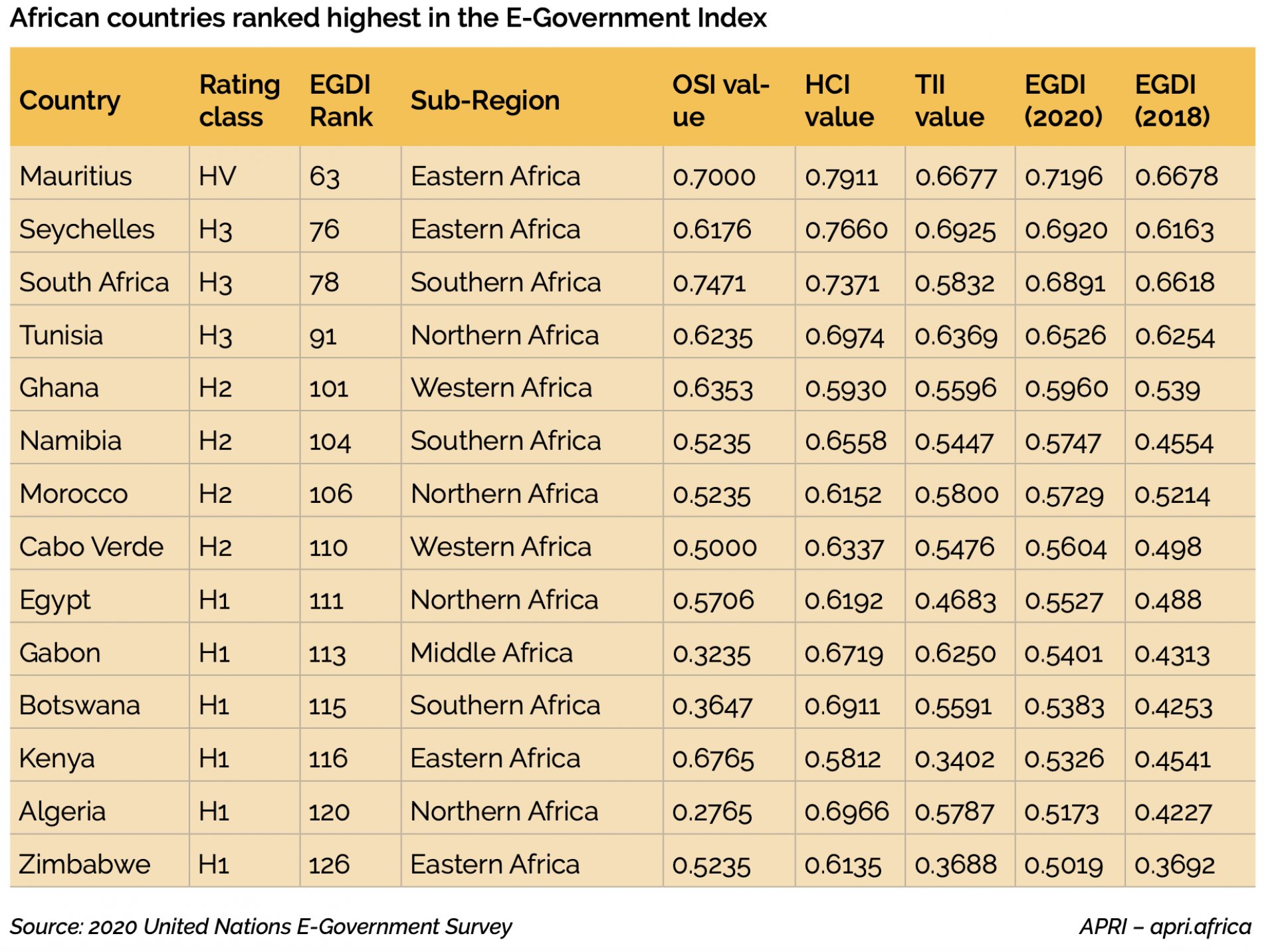

As stated in its Digital Mauritius 2030 Strategic Plan, Mauritius designates its ICT sector as the third pillar of its economy: it contributes 5.6% of its GDP, with a growth rate of 4.4%, employing over 23,000 citizens in more than 750 businesses. The extent to which the small island nation has leveraged digital technologies for its development is indeed reflected in the fact that it has the most perfect EGDI score among African countries. Mauritius has broadband penetration of 78.4%, mobile phone penetration of 145.6% and as many as 350 Wi-Fi hotspots within its 2000 square kilometer land area.

The digital strategic plan aims to increase the country's gains from digital technologies. It consists of five strategic waves. The first wave regards the further development of ICT infrastructure and broadcasting capabilities, the establishment of new submarine cables, providing satellite connectivity for outer islands, setting up a command-and-control center for the management of governmental networks and encouraging the adoption of artificial intelligence, internet of things and cloud computing.

The E-Government and Business Facilitation second strategic wave would have the country review its existing legal frameworks for the sustenance of digital government initiatives, set up chatbots on government websites, deploy artificial intelligence solutions throughout public service and positioning the country as an African technological gateway. The Talent Management third strategic wave aims at developing the capability of its citizens to work with ICT solutions, attracting both foreigners and diaspora Mauritians to work in the country, providing scholarships for ICT studies, providing virtual courses and a reconsideration of the school curricula to incorporate ICT content.

The Cybersecurity and Cybercrime fourth strategic wave entails the setting up of a Cyber Threat Center, issuing guidelines on safe cybersecurity practices and promoting its cybersecurity services in the southern Africa region. The fifth Innovation and Emerging Technologies strategic wave would see the country establish a Mauritius Artificial Intelligence Council, increase awareness of robotics and drive fintech services.

Egypt

Egypt has the distinction of being the only African country to have developed a national strategy for artificial intelligence (AI) – in addition to having a well-developed national strategy for ICTs alongside specific strategies for cybersecurity and e-commerce. The vision of the Egypt National Artificial Intelligence Strategy is to use AI technologies to achieve national sustainable development goals, positioning the country as a global player in AI and fostering regional cooperation within African and Arab regions. The strategy’s pillars include the rapid adoption of AI in government services and decision-making, deploying AI in every aspect of the economy, using public campaigns and professional training to prepare Egyptians for the AI era, and participating actively in global discussions around AI projects. Since the country only released its digital strategy for artificial intelligence in July 2021, monitoring its implementation is something to watch.

Egypt’s general approach to ICTs is articulated in the ICT 2030 Strategy, in line with the aspirations of its national development plan, Egypt Vision 2030. The ICT strategy focuses on creating an Egypt that is digitally transformed, where digital skills and jobs are abundant, government services are digitized, digital infrastructure is well developed, cybersecurity is guaranteed and both knowledge and innovation are at the core of the economy. The country has furthermore been implementing a standalone National Cybersecurity Security Strategy since 2017, with a focus on establishing appropriate legislative frameworks, developing a national cybersecurity system and equipping human expertise for its successful operation.

The country has also developed an E-Commerce Strategy – towards helping small businesses get online, encouraging medium and large business to invest in having a strong online presence, leveraging digital technologies to facilitate the entry of informal businesses into the formal sector and stimulating electronic payments for goods and services.

Kenya

Kenya has developed a detailed blueprint with which it aims to realize a buoyant digital economy. Titled the Digital Economy Blueprint, the vision is to empower citizens in a digital world. Its mission includes creating a digital economy that ensures that all its citizens, firms, and organizations have digital access, whilst providing them with the capabilities required to participate in exploiting the opportunities presented by the digital economy. The aim is for a vibrant digital economy to help the country leapfrog its development challenges.

The blueprint identifies five pillars of digital government, digital business, infrastructure, innovation-driven entrepreneurship, digital skills, and values. The digital government pillar entails using digital technologies to enhance the citizen-government relationship, with the government innovating to provide effective public service. Already, but not without controversy, the government has been registering its nationals both within and outside of its borders in an effort to issue them a Digital ID called Huduma Namba. It has also launched a Government to Citizen platform called e-Citizen, where citizens can apply for government services such as business registrations, marriage registrations, driving licenses and passport applications.

The digital business pillar involves consolidating the large increase in the country’s e-commerce businesses and already established mobile money services by consolidating digital trade, digital financial services, and digital content towards achieving economies of scale, further growth, and a reduction of operating costs for businesses. Meanwhile, the infrastructure pillar involves investing in broadband, 4G, interoperability among businesses and secure data centers to make the digital economy safe, affordable, and accessible, irrespective of physical residence in the country itself, as part of an inclusive economy.

The innovation-driven entrepreneurship pillar relates to helping people develop ideas that can be commercialized by providing funding for innovative research, developing talent, and supporting business models that make use of open access digital resources within the digital economy. The last pillar of digital skills and values concerns equipping citizens with basic, intermediate, and advanced digital skills. Basic skills include how to use a computer keyboard or send an email, intermediate skills include how to analyze data or create digital content, and advanced skills incorporate computer programming and network management. It remains to be seen whether the country will achieve these objectives, given the role that its Digital Services Tax may play in the development of its digital economy.

Senegal

Senegal has developed the Digital Senegal 2025 Strategy as part of its plans to revolutionize every aspect of its economy and become an emerging country by 2035. The strategy’s slogan of “digital technology for all and for all uses in 2025 in Senegal with a dynamic and innovative private sector in a high-performance ecosystem” succinctly describes the hopes that the country has placed in digital technologies and what it intends to achieve with them. The strategy has four axes with three prerequisites for upgrading the legal framework of digital technologies: improving human capital for creativity, productivity through technologies and ensuring cybersecurity and trust in the digital ecosystem.

In view of the currently high costs of internet access in the country, the first axis focuses on providing citizens with affordable access to ultra-high speed internet service by prioritizing national fiber optic coverage, investing in submarine cables and by facilitating the deployment of 4G and other ICT services in every part of the country. The second axis concerns deepening e-governance by increasing synergy and enhancing efficiency within the public service. It aims to accelerate the digitization of government services such that 40% of birth registrations, building permit applications, tax declarations, payments of duties and other administrative services are conducted online by 2025.

The third axis concerns promoting an innovative and value-creating digital industry through support for local investors in a 'Senegal Start-up' program. The fourth axis concerns the deployment of digital technology in priority sectors of the economy. These include improved agricultural productivity as farmers gain access to better agricultural and market information, a more robust fisheries sector as boats and canoes are registered for better maritime safety and illegal fishing is combatted using radar detection, a larger financial sector as mobile banking becomes more efficient, a better health service for citizens with the deployment of telemedicine and an improved education sector as technological programs are introduced in schools and virtual classes are used to decongest campuses.

Digital agenda as presented in national development plans

Gambia, Namibia, and Gabon are countries that do not have a standalone digital strategy or policy, yet nevertheless outline digital aspirations in their national development plans. Here, we examine the aspirations that these countries have outlined including Gabon's national development plan which has since run its course.

Gambia

In the country's National Development Plan 2018-2021, “Making the Gambia a Digital Nation and Creating a Modern Information Society” is outlined as one of the critical enablers of various developmental goals that include the restoration of good governance, a stabilized economy, improved health and education services and agricultural modernization. Upgrading ICT infrastructure, enhancing access to broadband, improving e-government with the establishment of a National Data Center, and ensuring cybersecurity are important digital plans of the country. In doing so, the country hopes to increase the percentage of its population that access the internet daily from 20% to 90%, increase mobile phone penetration from 78.9% to 90% and to double the proportion of schools that are connected to broadband Internet from 6% to 12% by the end of the planning period. The country has already recorded huge progress on mobile phone penetration with the figure standing at 164.1% of the population as of January 2021.It is currently unclear, however, whether an individuals’ multiple phone ownership may have driven the growth in mobile phone penetration. Internet access remains modest, however, with only 23.7% of the population accessing the internet daily in January 2021. Nevertheless, this represented as much as a 22.8% increase from the level in 2020.

Namibia

Namibia has been working towards harmonizing various policies and initiatives into a single National ICT Policy. Its 5th National Development Plan (NDP5) for the period 2017/18 - 2021/22 outlines it’s vision of a Namibia with a knowledge-economy and “universal access to information, affordable communication and technology infrastructure and services” by 2022. The country specifically aims at having 90% of its population covered by broadband infrastructure by 2022, up from the 21% that had coverage in 2015. It also envisages an increase from 74.4% to 93% for digital terrestrial television coverage, from 78% to 90% for FM radio coverage, from 141 postal outlets to 152 and from 30% to 80% for the percentage of the population with access to online news. Schools and health facilities had broadband coverage of 25% and 13% respectively in 2015. The country aims to expand the coverage to 100% and 80%, respectively, for all its schools and health facilities by 2022.

One of the strategies for achieving these goals is having digital technologies integrated into all sectors of its economy, with particular attention given to e-business, e-learning, e-health, and e-governance. Upgrading the national digital infrastructure, building new radio and TV transmitter stations, implementing different measures to ensure affordable Internet access as well as establishing internet connectivity in remote areas are some of the other strategies outlined by the country towards achieving its digital aspirations.

Gabon

The Emerging Gabon Strategic Plan sets forth Gabon's plans to be an emerging nation, with more of an emphasis on its human capital than its natural resources. This reflects the greater influence of knowledge in the global economy, in which the middle class will form the majority by 2025. Building a world-class digital infrastructure and creating a digital economy that is both dynamic and innovative are key strategies for achieving these objectives. The country further outlines plans for e-government and ensuring cybersecurity via appropriate cyber legislations.

In the available 2011-2016 strategic orientations, the country anticipated that by 2016 it should have digital infrastructure across all of its territory (both rural and urban), improved digital services, faster internet service, cheaper internet costs, greater digital inclusion for low-income demographics, an effective e-governance and a digital economy policy. As the country is yet to achieve a digital economy, however, some of the plans were certainly not met in 2016. Nevertheless, based on data from the E-Government Development Index, the country has been making advancements in its digital aspirations. Its EGDI score for 2016 was 0.3584 as opposed to 0.4313 and 0.5401 in 2018 and 2020 respectively.

Digital agenda as presented in disparate documents, policies, laws, and activities

Some other countries have elements of a digital strategy in disparate policy documents and initiatives. Ghana and Zambia are in this category. Some also have these expressed as laws – for example Algeria, which has a law on e-commerce, among others.

Ghana

While Ghana developed an Integrated ICT for Accelerated Development (ICT4AD) Policy in 2003, it currently aims to develop a digital strategy as part of Ghana Beyond Aid, which is its vision document. However, it has already produced a host of documents that collectively provide a view of what its digital agenda might look like. These include a National Financial Inclusion and Development Strategy (NFIDS) 2017-2023, a Digital Financial Services Policy and a Ghana Digital Payments Roadmap that are, in one way or another, aimed at supporting financial inclusion goals, enabling an appropriate regulatory framework, supporting the development of market infrastructure for digital financial services, supporting fintech and enhancing the robustness of the digital economy. It has also launched a National Cyber Security Policy & Strategy document towards ensuring the safety of its cyberspace and an enhanced digital economy as a result of this.

Zambia

Zambia has made significant progress in digital infrastructure by connecting all provincial centers to the fiber backbone and building what has been described as a state-of-the-art data center that can support both governmental and commercial usage. It has also made strides in e-government and lowered the transaction cost of digital financial services. Use of digital finance services has increased from 26% in December 2018 to 39% in December 2019. Some of the documents in which the government expresses its digital aspirations include the Smart Zambia Master Plan and the Smart Zambia e-Government Plan.

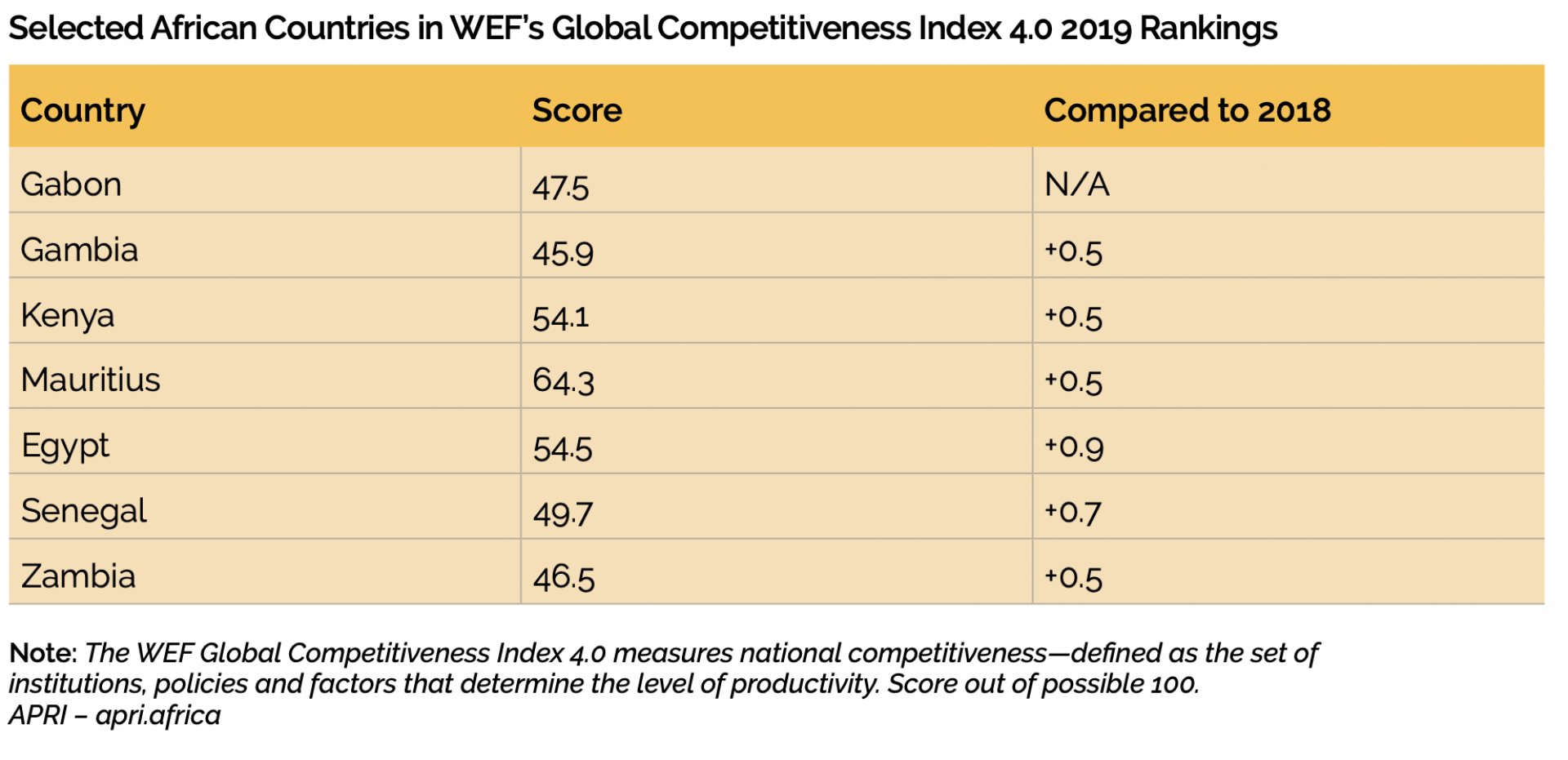

The trends in Africa’s digital agenda

Our analysis so far shows that certain issues appear to be a priority for African governments. Viewed together, one begins to get a sense of an emerging digital agenda for Africa and the vision that African countries have in their approach towards digital space from a policy perspective.

The broad tenets of Africa’s digital agenda are discussed in turn in the rest of this section.

Digital Infrastructure

The importance of physical infrastructure cannot be over-emphasized. Without such infrastructure, nothing else can be developed. African countries have focused on this. More than 30 African governments (55% of the continent) have procured 3G networks, while more than 20 countries (36% of the continent) have built fiber-optic networks and e-government platforms.

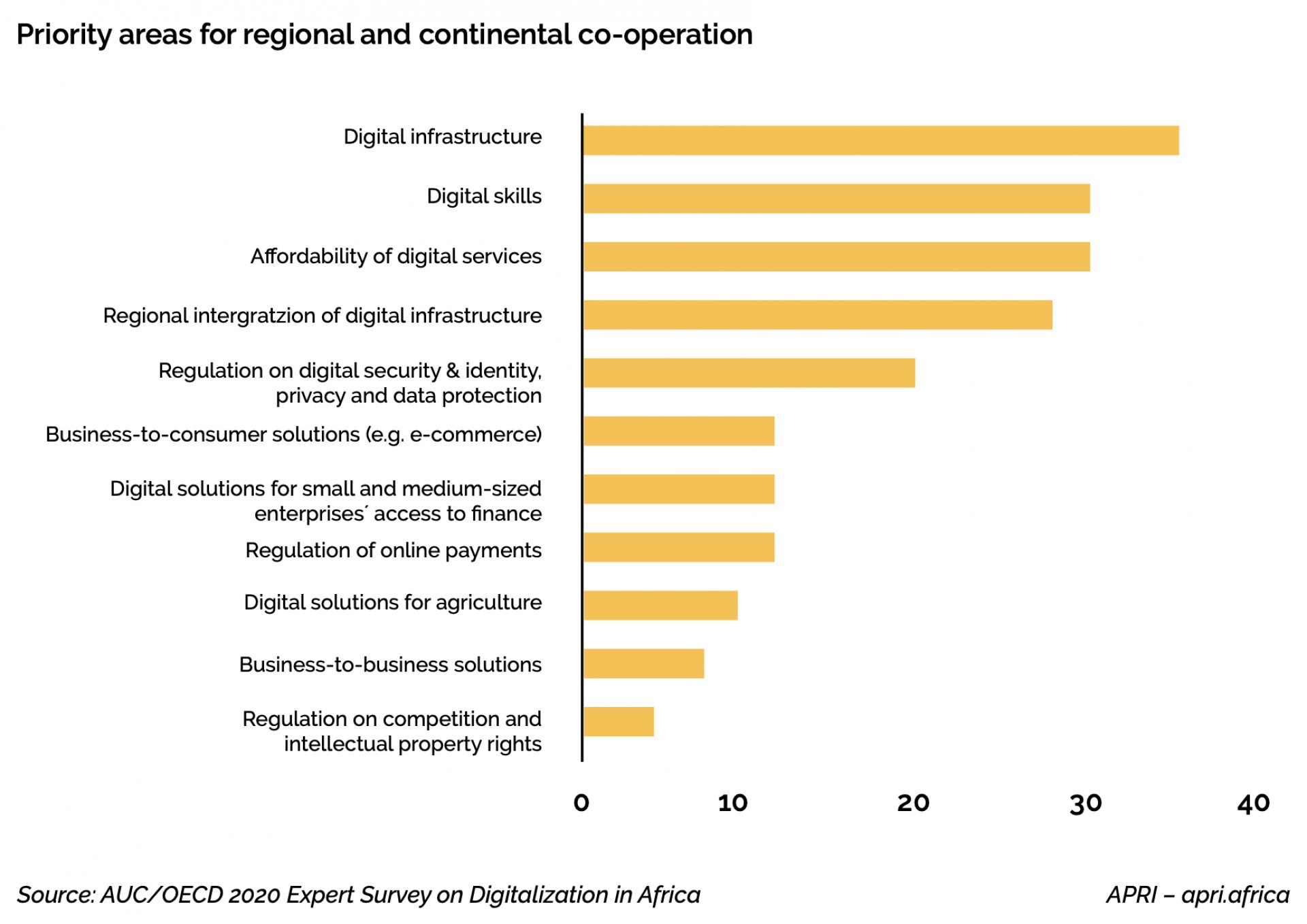

On the regional front, of the projects on the Dashboard of the Program for Infrastructure Development in Africa, a continental program designed to support the development of regional and continental infrastructure projects, digital infrastructure boasts second place in the number of projects either ongoing or already completed. This is second only to transport infrastructure. The importance of a regional focus for achieving results in the development of digital infrastructure was also underscored by an AUC/OECD expert survey on digitalization in Africa, with digital infrastructure being cited most often as the area of priority.

E-government

E-government has been receiving increasing attention from African governments in the past decade. Virtually all the digital strategic plans and national development plans that are reviewed here have elements of e-government included in them. Even though UN data shows that Africa as a continent generally lags behind other regions on e-government, significant gains have been made in the past years.

A few concrete examples of how African countries are approaching e-government include the Unified eXchange Platform (UXP) interoperability platform in Namibia, through which different state institutions are integrated into a single platform for efficiency; a Government Integrated Financial Management Information System (GIFMIS) in Nigeria; an e-tax solution in Botswana; cash registers that are directly connected to the tax authority in Ethiopia; e-state portal, Irembo, in Rwanda; text messaging services for disaster preparedness warnings in Madagascar and a regional e-governance academy under development in Mauritius. These are but a few examples of e-governance solutions that are being developed to solve locally identified problems and in collaboration with foreign partner countries.

Cybersecurity

Almost all the digital plans reviewed make mention of cybersecurity and improving confidence in the use of digital services. However, this is not often translated into policy and practice. Most countries have yet to develop national cybersecurity strategies or data protection regulations and laws. In 2014, African countries adopted the African Union Convention on Cyber Security and Personal Data Protection, otherwise known as the Malabo Convention. In 2019, the African Union Commission set-up the African Union Cyber Security Expert Group (AUCSEG), which is tasked with advising the Commission and member countries on how to respond to cyber threats.

Countries that have started addressing cybersecurity include Egypt, Ghana, Morocco, Nigeria, and South Africa. Senegal has also gone further to strengthen what it considers to be its digital sovereignty. In June 2021, President Macky Sall ordered his government to transfer all of its data to national data centers. At the launch of a new data center he said: “I’m instructing the government from henceforth to migrate all state data and platforms to the data center. We have to rapidly repatriate all national data hosted out of the country”.

E-commerce

Even before COVID-19 led to an increase in e-commerce on the continent, Africa had been witnessing growth in the sector. According to the United Nations Conference on Trade and Development (UNCTAD)’s E-commerce Readiness Index, the African countries that have been most active in the sector are Mauritius (scoring at 68.4 out of 100), Tunisia (58.1), South Africa (54.4), and Nigeria (53.2). The index tracks four dimensions including a country’s percentage of internet users, the percentage of its population with access to bank accounts, scores given to the security of its web servers and the score given to the reliability of its postal services. Crucial hurdles include a lack of trust, lack of bank accounts (with only 10 to 15% of Africans having a bank account), lack of traditional addresses (especially in rural areas) and unreliability of postal services in addition to personnel and infrastructural difficulties in crossing borders.

The promises e-commerce holds for Africa have been widely reported – and it appears that governments are taking heed of the advice to improve the regulatory environment, both individually as countries and collectively as a continent. With the entry into force of the African Continental Free Trade Area (see below), e-commerce agenda is likely to receive more attention.

Taxing digital services

Although not prominent in national digital plans, digital taxation is an emerging topic in Africa – so much so that the African Tax Administration Forum (ATAF), an African pan-governmental organization, has issued a ‘Suggested Approach document’ to drafting legislation on digital sales tax services in Africa. This should be read alongside other global initiatives on how to tax digital services, namely, the OECD’s Two-Pillar approach and the G7’s new proposal for minimum tax rates for multinational companies. ATAF has already responded to the Pillar One of OECD’s proposals from an African perspective. The central point of both of ATAF’s interventions is that there are some specificities to the African context that need to be taken into account when a digital services tax is considered in either a global or African framework.

Some African governments already have digital services tax of some kind. Notable cases include Kenya, Nigeria, Tunisia, and Zimbabwe. According to Deloitte, Egypt is considering implementing one. South Africa has introduced it within its value added tax (VAT) and has issued a white paper which contains a proposal on extending TV license fees to streaming services. Digital taxation also carries a political dimension, however. Uganda has, for instance, recently imposed a tax on social media websites in the country, a move that has been widely interpreted as an attempt towards curbing the mobilization of activists and opposition parties. This was subsequently replaced with a general digital tax.

Striking a balance between generating revenue and not being punitive on civil society is crucial and requires some trade-offs. The stage at which the digital value chain tax is imposed and who the taxpayer should be are also necessary factors to consider. For example, the social media tax in Uganda has been imposed on users after they purchase data as opposed to being levied on the social networks themselves. This “digital lawfare” gives further credence to the need for a continental – and indeed global – taxation approach on digital activities.

How does the emerging agenda fit with the continental agenda?

In 2020, the African Union Commission introduced a comprehensive Digital Transformation Strategy for Africa. The Strategy builds on initiatives and frameworks such as the Policy and Regulatory Initiative for Digital Africa (PRIDA). It is also designed explicitly to support and connect with the AfCFTA. Its central objective is for Africa to use digital technologies and innovation to transform Africa, to generate inclusive growth, create jobs and ensure African ownership of digital technologies. To do this, it aims to spur the creation of a Digital Single Market in Africa by 2030, whilst providing a roadmap towards achieving that goal.

In its broadest terms, these include foundational pillars such as the creation and harmonization of policies, legislations and regulations, the creation of digital infrastructure (especially cross-border infrastructure), ensuring that Africa’s digital skills gap is filled, ensuring that Africa is literate in up-to-date digital skills, innovation and entrepreneurship strategies and ensuring the correct balance to allow digital entrepreneurship, including intellectual property (IP) rights. The sectors that the Strategy seeks to see transformed digitally, in addition to the digital industry itself, are trade and financial services, governance, education, health and agriculture. Cybersecurity, privacy, and personal data protection are all cross-cutting themes. These represent the core areas present in Africa’s emerging digital agenda. The key challenge, however, is connecting those continental and regional agendas that are likely to be affected by the digital agenda (e.g., e-commerce activities under the AfCFTA) to national efforts.

Different writers have highlighted some of the key considerations African countries would have to make as they prepare to commence negotiating the e-commerce protocol of the AfCFTA. A recent ODI study, for instance, argues that African countries might want to first reflect on the classification of digital products before commencing negotiations. A Tralac article added other elements to consider, suggesting that African governments might have to consider the reasons behind the African Group at the WTO’s opposition to the introduction of an e-commerce rule at the WTO. The e-commerce protocol certainly offers plenty of opportunity for Africa. Beyond providing guidance on how intra-African trade in digital services would work, it promises to help understand what the African position on cross-border trade in digital services entails. This position could feed into other future agreements that African countries might negotiate, either bilaterally or as part of a multilateral process.

Cooperation with the EU

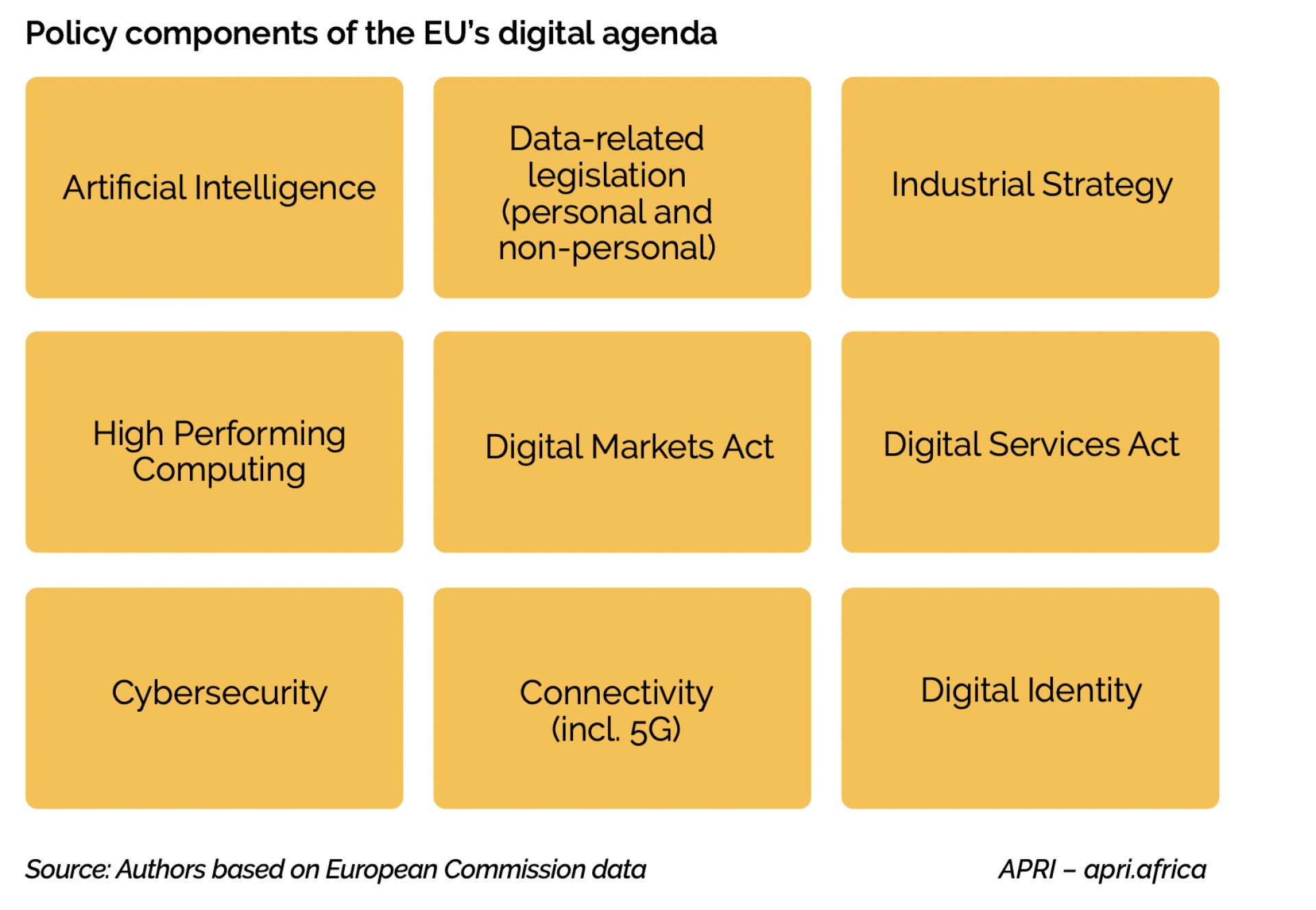

As in Africa, the EU has also developed its digital transformation strategy. The strategy is built on the premise that data constitutes a key resource for the future on security/political and economic fronts, even as the line between the two is often blurred. As the value of the data economy within the EU region is expected to increase from around EUR325 billion (USD385 billion) (2.4% of the EU’s GDP) to an estimated EUR829 billion (USD977 billion) by 2025 (5.8% of the EU’s GDP), control over data, its transfer, and use within the EU has been central in the bloc’s digital policy.

The EU is indeed recognized as a leader in terms of the data protection. Several policies and legislative packages exist or are being developed to strengthen the EU’s hold on the data of its nationals and firms. It developed the first of its kind General Data Protection Regulation (GDPR), which seeks to regulate the transfer of data and the handling of personal information within and outside of the EU. A similar regulation on the flow of non-personal data, including in relation to industry and cloud computing, has also been in effect since 2019.

In April 2021, the European Commission (EC) put forward a proposal for an Artificial Intelligence Act, which combined security/political concerns with economic ones. This complements the main cybersecurity-related legislation, namely the Directive on the Security of Network and Information Systems (NIS), which has been in effect since 2016.

While the EU’s success in moving towards harmonized digital policies is most visible in the area of data management, it has been making headways in several interconnected areas. Indeed, since 2016, the EU has been ramping up its regulatory frameworks around digital transformation and industrialization. It introduced new legislative texts on the use of data for industrial ends at the time. In 2020, it further introduced a legislative proposal for a Digital Markets Act as well as a Digital Services Act, both aimed towards upgrading regulations within the internal market. It has also indicated a willingness to move ahead with imposing digital taxes on multinationals while working within the framework of the G20 and the OECD for a global solution.

It is evident from the above that the EU is developing a complex system in relation to digital transformation. Domestic policy is not the only focus, however, as the bloc makes no secret of its ambition to become a global leader in the process of shaping its own “digital future”. Three EU-identified areas are of particular focus. They include becoming a role model for the digital economy, supporting developing economies in going digital and developing digital standards with the intention of promoting them internationally. In this respect, the European Commission argues that “a Global Digital Cooperation Strategy will put forward a European approach to the digital transformation… and will project them onto the international stage and engage with our partners… in Africa and elsewhere”.

Understanding the role of development assistance as a tool of foreign policy here is critical since the implementation of these EU ambitions is done through classical cooperation instruments, including bilateral and continental cooperation. Bilaterally, the EU has de facto introduced a legal obligation on African countries members of the Africa, Caribbean, and Pacific Group to comply to the GDPR regulation within the framework of the newly negotiated agreement between the EU and the group. This is, for instance, evident in using definitions drawn from the GDPR legal text and incorporating them into the EU-ACP agreement.

To take but one example, Article 15 of the newly concluded agreement between the EU and the ACP, which deals with the processing of personal data, draws its text from the preamble of the GDPR regulation. This is a consequential commitment on the part of the signatories. Enforcing such a regulation will prove challenging, however, and will require signatories to introduce new regulations in order to ensure that they are compliant with their legal obligations under the new EU-ACP Agreement. So far, the majority of African countries have digital regulations, but only South Africa has a comprehensive legal framework comparable to that of the EU.

In January 2021, the EU announced that it would be supporting six new digital projects across multiple sectors under the Pan-African Program. In the process, it earmarked some EUR82.5 million (USD97.2 million) to support the projects of the 2014-launched program for an assortment of areas centered around education and capacity-building. Previously, from 2018-2020, the EU had provided some EUR400 million (USD471 million.)

The six projects will touch on various sectors as determined by the EU, including “air transport, digitalization, regional integration and trade, and sustainable resource management.” The breakdown of the funding consists of the following:

- African Continental Free Trade Area (AfCFTA) (38.7%).

- Food security and ecosystem monitoring using space technology (30.3%).

- Sustainable management and governance of natural resources using geoscientific data (9.6%).

- Digitalization and knowledge sharing (9.6%).

- Safer aviation infrastructure using satellite systems (6%).

- Modernization of air navigation systems (5.4%).

Specifically on digitization, the EU pledges to support the newly introduced Africa-Europe Digital for Development Hub with funds totaling EUR8 million (USD9.4 million). The Hub, which is a unilateral tool not yet approved by African countries, aims to facilitate “knowledge-sharing and structured dialogue” between the two partners with the aim of boosting digital transformation.

At the continental level, the EU has also steered several initiatives and brought them into the AU-EU partnership framework. This is the case, for instance, under the so-called Africa-Europe Digital Economy Partnership. Although the legal implications of continental initiatives are minimal compared to those concluded bilaterally, the success of the EU in imposing its ideas signals its capacity to ensure the alignment of non-EU countries to its own policies. In the case of Africa, this may be detrimental. For instance, questions on how rules around the digital economy support the AfCFTA are yet to be answered, largely because some aspects, primarily the e-Commerce protocol, are still under discussion among African negotiators. Furthermore, the enforcement infrastructure to meet legal obligations will require significant adjustments both in financial terms and in domestic legislation.

Conclusions and policy issues for further consideration

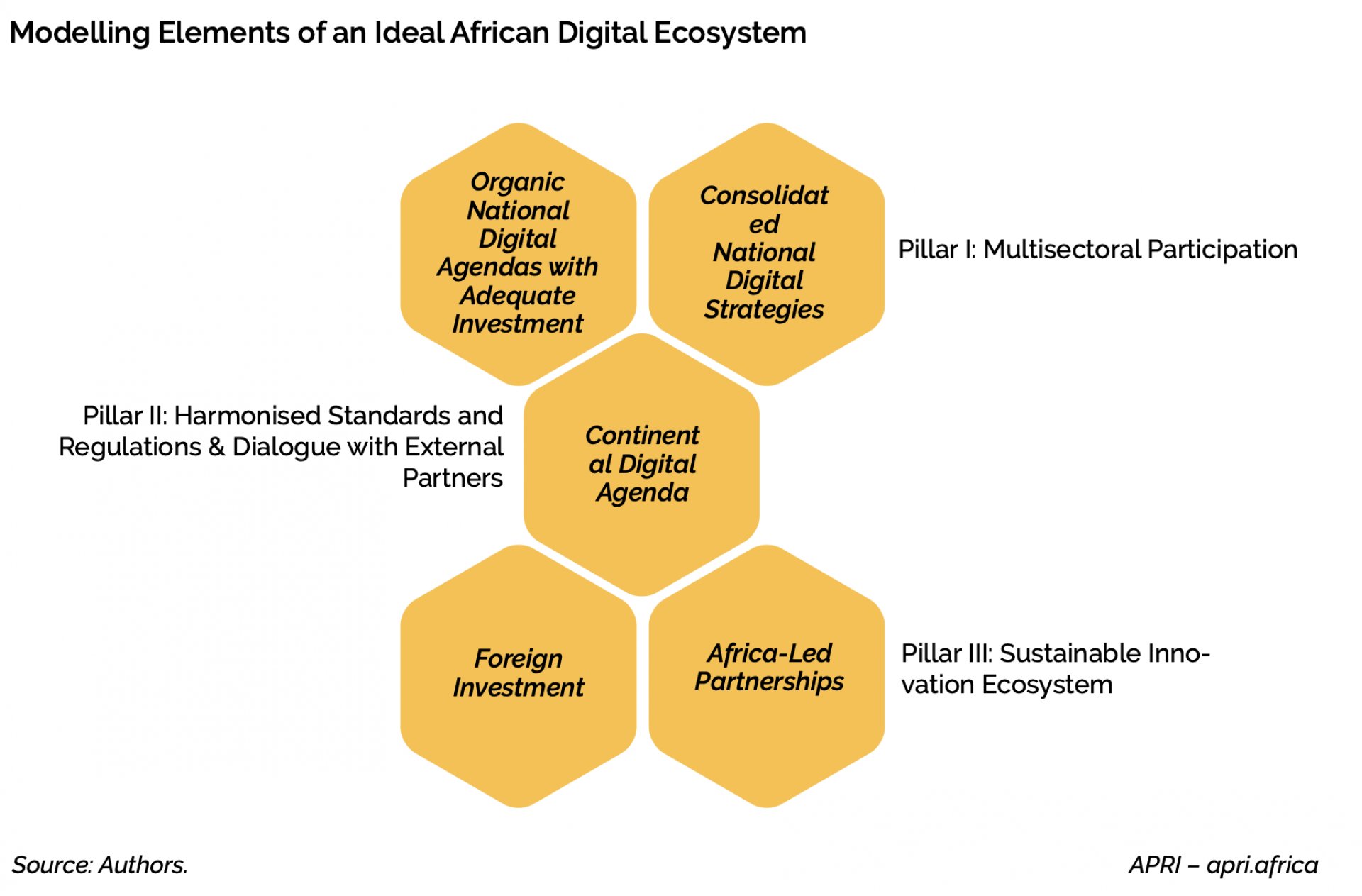

Based on the findings above, the figure below represents what we propose to be the ideal digital agenda landscape. It factors in three levels: the domestic, the continental and international partnerships. These are flanked by necessary pillars. At the first level, there needs to be participation by a variety of actors in creating national digital agendas – there has so far been a relative lack of multi-sector and multi-actor involvement in the development of national agendas (with some notable exceptions, e.g., Senegal). At the second level, these national agendas need to be consolidated and harmonized as much as possible. At the international level, major multinational corporations in the digital and related sectors and partner states adhere to this framework developed from the bottom up and in accordance with the continent’s identified priorities.

As Africa considers foreign partnerships in the digital space, the process of Africa’s digitalization needs to be owned by the continent for the following reasons:

- It ensures a greater rate of success because the regulations and objectives are developed within specific contexts.

- Digital models adopted from, or introduced by, different partners with divergent visions (e.g., China, the EU, the US, or Russia) are, ironically, likely to lead to further divergences in standards and a stunting of the continent’s digital landscape.

- It guarantees against potential reneging of regulations and objectives since these are “owned” by the African stakeholders and reflect their aspirations.

- African leadership in setting its own digital landscape is more likely to lead to innovation within the continent as externally sourced regulations can stifle local innovation.

While African countries are making significant strides in infrastructure development and the drafting of regulations, the scope and depth of the latter need to be further aligned to the continent’s future ambitions. Considering that a domestic economy cannot be an island in a digital world, a continental approach is indeed required. The key advantages of such an approach include the following:

- Resource conservation:as the continent seeks to become integrated through the AfCFTA, it is doing so in an increasingly digital world. Connecting digital agendas as part of the negotiations for the AfCFTA will help avoid the costs that would inevitably be incurred should the issue be left to the future. It will also help the continent reap the benefits offered by the AfCFTA by providing possibilities for the creation of regional hubs with respect to infrastructure (e.g., data centers).

- Investment attraction: as companies increasingly pursue regional markets to ensure scale, the continent will be able to present itself as more compelling investment opportunity if it has a harmonized approach to digital regulations.

- Common approach to digital taxation: for African countries to extract benefits from the digitalized economy, it will be crucial for them to have a common standard and approach to taxing digital services. This will also prevent a race to the bottom, but it can also form an African position to taxing the digital economy – in the face of the G7 proposal.

- Human rights protection: a harmonized continental standard that ensures human rights protections would provide be a stronger tool for holding national governments as well as foreign actors to account.

About the Authors

Olumide Abimbola

Olumide Abimbola is founder and director of APRI. He currently sits on the International Board of the Institute for Money, Technology and Financial Inclusion (IMTFI) at the University of California, Irvine, and is Member, Policy Working Group, at the Institute of Humanities in Africa (HUMA) of the University of Cape Town, South Africa.

Faten Aggad

Faten Aggad is Senior Advisor to the AU High Representative on relations with the European Union and Founder of Afriprism Consulting. She sits on the Advisory Editorial Board of the South African Journal of International Affairs as well as the Board of Changes for Humanity.

Bhaso Ndzendze

Bhaso Ndzendze is Head of Department at the University of Johannesburg and is Visiting Research Fellow at APRI. He was previously research director at the Center for Africa-China Studies at the University of Johannesburg. His most recent book is AI and Emerging Technologies in International Relations.

Acknowledgements

The authors would like to thank Olayemi Soneye, Neo Letswalo and Mancha Johannes Sekgololo for their smart and diligent support in the research that underpins this brief. They would also like to thank Neema Iyer and Ibhraheem Sanusi for reviewing an earlier draft of the paper. Responsibility for the content lies with the authors, and all mistakes are their own.

Suggested Citation: Abimbola, O., Aggad, F., Ndzendze, B. 2021. ’What is Africa’s Digital Agenda?,’ Policy Brief No. 3. Berlin: APRI

References

African Tax Administration Forum. 2021. ATAF Sends Revised Pillar One Proposals to the Inclusive Framework. Accessed September 12, 2021. https://www.ataftax.org/ataf-sends-revised-pillar-one-proposals-to-the-inclusive-framework

African Union. 2014. African Union convention on cyber security and personal data protection. African Union. Accessed August 14, 2021. Link here

African Union. 2020. The Digital Transformation Strategy for Africa (2020-2030). Accessed September 12, 2021. https://au.int/sites/default/files/documents/38507-doc-dts-english.pdf

African Union. 2021. PIDA Projects Dashboard. Accessed September 12, 2021. https://www.au-pida.org/pida-projects/

AUC/OECD. 2021. Africa’s development dynamics 2021: digital transformation for quality jobs. Paris: AUC, Addis Ababa/OECD. doi: https://doi.org/10.1787/0a5c9314-en.

Banga, Karishma, Mohamed Gharib, Max Mendez-Parra, and Jamie Macleod. 2021. E-commerce in preferential trade agreements: implications for African firms and the AfCFTA. London: ODI. Accessed August 2, 2021. https://cdn.odi.org/media/documents/e-commerce_in_preferential_trade_agreements_report.pdf.

E-Citizen. 2021. Accessed September 12, 2021. https://www.ecitizen.go.ke

EU and OACPS Chief Negotiators. 2021. "Partnership agreement between the [European Union/European Union and its Member States], of the one part, and Members of the Organization of African, Caribbean and Pacific States, of the other part." Negotiated Agreement text. Accessed August 2, 2021. https://ec.europa.eu/international-partnerships/system/files/negotiated-agreement-text-initialled-by-eu-oacps-chief-negotiators-20210415_en.pdf.

EU. 2021. Building a data economy - Brochure. European Commission, January 21. Accessed July 20, 2021. https://digital-strategy.ec.europa.eu/en/library/building-data-economy-brochure.

EU-AU Digital Economy Task Force. 2019. New Africa-Europe digital economy partnership: accelerating the achievement of the sustainable development goals. Brussels: European Commission. https://ec.europa.eu/newsroom/dae/document.cfm?doc_id=60075.

European Commission. 2020. Shaping Europe’s Digital Future. Accessed September 12, 2021. https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=COM%3A2020%3A0067%3AFIN

European Commission. 2020. EU mobilises €82.5 million to strengthen cooperation with Africa in digital and space technology. Brussels, December 21. Accessed August 8, 2021. https://ec.europa.eu/international-partnerships/news/eu-mobilises-eu825-million-strengthen-cooperation-africa-digital-and-space-technology_en.

European Commission. 2020. Regulation of the European Parliament and of the Council on contestable and fair markets in the digital sector (Digital Markets Act). Proposal, Brussels: European Commission. Accessed August 2, 2021. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020PC0842&from=en.

European Commission. 2021. Regulation of the European Parliament and of the Council: Laying down harmonised rules on artificial intelligence. Proposal, Brussels: European Commission. Accessed April 21, 2021. https://eur-lex.europa.eu/resource.html?uri=cellar:e0649735-a372-11eb-9585-01aa75ed71a1.0001.02/DOC_1&format=PDF.

European Parliament. 2016. "Directive (EU) 2016/1148 of the European Parliament and of the Council of 6 July 2016 concerning measures for a high common level of security of network and information systems across the Union." Official Journal of the European Union L 194/1-30. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32016L1148&rid=1.

European Parliament. 2016. "Regulation (EU) 2018/1807 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data and repealing Directive 95/46/EC." Official Journal of the European Union L 119/1-88. Accessed July 30, 2021. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32016R0679&from=EN.

European Parliament. 2018. "Regulation (EU) 2018/1807 of the European Parliament and of the Council of November 2018 on a framework for the free flow of non-personal data in the European Union." Official Journal of the European Union L 303/59-68. Accessed July 15, 2021. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018R1807&rid=2.

Gouvernement d'Algérie. 2018. Loi n° 18-05 du 24 Chaâbane 1439 correspondant au 10 mai 2018 relative au commerce électronique. Accessed September 12, 2021. https://www.droit-afrique.com/uploads/Algerie-Loi-2018-05-commerce-electronique.pdf

Government of Egypt. 2021. "Egypt National artificial intelligence strategy." Accessed July 30, 2021. https://mcit.gov.eg/Upcont/Documents/swf/Egypt-National-AI-Strategy-English/index.html.

Government of Egypt. n.d. "ICT 2030 strategy." Accessed July 25, 2021. https://mcit.gov.eg/en/ICT_Strategy.

Government of Egypt. n.d. "National cybersecurity strategy." Accessed July 30, 2021. https://mcit.gov.eg/en/Publication/Publication_Summary/6132.

Government of Gabon. 2011. "Strategic plan for an emerging Gabon." Accessed July 5, 2021. https://www.cabri-sbo.org/en/documents/strategic-plan-for-an-emerging-gabon.

Government of Ghana. n.d. "Digital financial services policy." Accessed July 5, 2021. https://www.mofep.gov.gh/sites/default/files/acts/Ghana_DFS_Policy.pdf

Government of Ghana. 2019. "Ghana beyond aid: charter and strategy document." Accessed July 5, 2021. http://osm.gov.gh/assets/downloads/ghana_beyond_aid_charter.pdf

Government of Ghana. 2003. "Integrated ICT for accelerated development (ICT4AD) policy." Accessed June 30, 2021. https://moc.gov.gh/sites/default/files/downloads/Ghana-ICTAD Policy-Master-final-2.pdf.

Government of Ghana. 2015. "National cyber security policy & strategy." Accessed July 7, 2021. https://unidir.org/cpp/en/states/ghana.

Government of Ghana. 2018. "National financial inclusion and development strategy (NFIDS) 2017-2023." Accessed July 8, 2021. https://mofep.gov.gh/sites/default/files/acts/NFIDs_Report.pdf

Government of Ghana. n.d. "Toward a cash-lite Ghana: building an inclusive digital payments ecosystem." Accessed July 6, 2021. https://mofep.gov.gh/sites/default/files/acts/Ghana_Cashlite_Roadmap.pdf

Government of Kenya. 2019. "Digital economy blueprint: powering Kenya's transformation." Accessed July 6, 2021. https://www.ca.go.ke/wp-content/uploads/2019/05/Kenyas-Digital-Economy-Blueprint.pdf.

Government of Mauritius. 2018. "Digital Mauritius 2030 strategic plan." Accessed July 5, 2021. https://bit.ly/3CXnSfo.

Government of Namibia. 2017. "5th national development plan." Accessed July 5, 2021. https://www.ecb.org.na/images/docs/Investor_Portal/NDP5.pdf.

Government of Senegal. 2016. "Digital Senegal 2025 strategy." Accessed July 5, 2021. https://www.sec.gouv.sn/sites/default/files/Strat%C3%A9gie S%C3%A9n%C3%A9gal Num%C3%A9rique 2016-2025.pdf.

Government of South Africa. 2020. Draft The White Paper on Audio and Audiovisual Content Services Policy Framework: A New Vision for South Africa 2020. Accessed September 12, 2021. https://www.gov.za/sites/default/files/gcis_document/202010/43797gon1081.pdf

Government of the Gambia. 2017. "National development plan 2018-2021." https://mofea.gm/ndp.

Hunter, Qaanitah. 2019. 'We can’t be held back by US jealousy,' says Ramaphosa on Huawei sanctions. Times Live, July 05. Accessed June 28, 2021. https://www.timeslive.co.za/politics/2019-07-05-we-cant-be-held-back-by-us-jealousy-says-ramaphosa-on-huawei-sanctions/.

Kastner, Ariel. 2021. 7 views on how technology will shape geopolitics. World Economic Forum, April 21. Accessed June 28, 2021. https://www.weforum.org/agenda/2021/04/seven-business-leaders-on-how-technology-will-shape-geopolitics/.

Kemp, Simon. 2021. Digital 2021: The Gambia. DataReportal, February 11. Accessed August 12, 2021. https://datareportal.com/reports/digital-2021-gambia.

Kidera, Momoko. 2020. Huawei's deep roots put Africa beyond reach of US crackdown. Nikkei Asia, August 15. Accessed July 2, 2021. https://asia.nikkei.com/Spotlight/Huawei-crackdown/Huawei-s-deep-roots-put-Africa-beyond-reach-of-US-crackdown.

Lapõnin, Karin Kaup. 2018. E-governance challenges in Africa. International Center for Defence and Security, August 17. Accessed July 30, 2021. https://icds.ee/en/e-governance-challenges-in-africa/.

Macdonald, Avang. 2021. Kenya’s Huduma Namba digital ID scheme could exclude millions of citizens, Forum warns. Biometric Update.com, January 31. Accessed August 14, 2021. https://www.biometricupdate.com/202101/kenyas-huduma-namba-digital-id-scheme-could-exclude-millions-of-citizens-forum-warns.

Marshall, Andrea. 2011. China's mighty telecom footprint in Africa. New Security Learning, February 14. Accessed June 25, 2021. http://www.newsecuritylearning.com/index.php/archive/75-chinas-mighty-telecom-footprint-in-africa.

Mekgoe, Norman, and Mohamed Hassam. 2020. Digital services tax in Africa – The journey so far. Deloitte, August 6. Accessed July 20, 2021. https://www2.deloitte.com/za/en/pages/tax/articles/digital-services-tax-in-africa-the-journey-so-far.html.

Muhleisen, Martin. 2018. The long and short of the digital revolution. Finance & Development Magazine of the International Monetary Fund, June. Accessed June 28, 2021. https://www.imf.org/external/pubs/ft/fandd/2018/06/impact-of-digital-technology-on-economic-growth/muhleisen.htm.

Nakale, A. 2021. Namibia: National ICT Policy On the Cards. AllAfrica, April 27. Accessed July 30, 2021. https://allafrica.com/stories/202104270619.html.

National Assembly of Zambia. n.d. "Ministerial statement on progress on the Smart Zambia Vision." Accessed July 30, 2021. https://www.parliament.gov.zm/node/8089

Ogo, Ify. 2020. An agenda for the AfCFTA Protocol on e-commerce. Tralac, June 25. Accessed July 25, 2021. https://www.tralac.org/blog/article/14692-an-agenda-for-the-afcfta-protocol-on-e-commerce.html.

Reuters. 2019. Five eyes will not use Huawei in sensitive networks: senior US official. Reuters, April 24. Accessed July 20, 2021. https://www.reuters.com/article/us-britain-huawei-ncsc-usa-idUSKCN1S01CZ.

Reuters. 2021. Senegal aims for digital sovereignty with new China-backed data center. Reuters, June 22. Accessed June 30, 2021. https://www.reuters.com/article/senegal-datacenter-idINL5N2O44D3.

United Nations Conference on Trade and Development. 2017. "ICT policy review: national e-commerce strategy for Egypt." https://unctad.org/system/files/official-document/dtlstict2017d3_en.pdf

United Nations Department of Economic and Social Affairs. 2021. Country Data on Gabon. Accessed September 12, 2021. https://publicadministration.un.org/egovkb/en-us/Data/Country-Information/id/62-Gabon/dataYear/2016

United Nations Department of Economic and Social Affairs. 2021. Regional Data. Accessed September 12, 2021. https://publicadministration.un.org/egovkb/en-us/Data/Region-Information

United Nations Conference on Trade and Development. 2019. "The UNCTAD B2C E-commerce Index 2019." UNCTAD. Accessed July 5, 2021. https://unctad.org/system/files/official-document/tn_unctad_ict4d14_en.pdf