The proposed Pan-African Trade and Investment Agency could transform Africa's investment landscape, driving funding and collaboration under the AfCFTA umbrella.

Negotiations towards finalising the African Continental Free Trade Area (AfCFTA) agreement have been progressing speedily, and a number of constituent protocols have been successfully adopted. Among them is the Protocol on Investment, which seeks to harmonise the regulatory environment for intra-African investment while promoting, protecting and facilitating investment flows. Of particular interest is the protocol’s provision for a new continental institution - the Pan-African Trade and Investment Agency, PATIA.

This agency will essentially be a continental investment promotion agency (IPA) and will be mandated to help coordinate investment promotion and facilitation efforts of the AfCFTA state parties. It will serve as a platform for coordination and exchanges among state parties, facilitating the sharing of trade-related data, opportunities for investment, knowledge sharing and industry best practices. Additionally, the agency will work with governments and national investment promotion agencies in enhancing their capacity to develop and implement investment strategies that encourage investments within Africa, especially those that lead to a growth in exports.

There are several reasons why the proposed agency is positive for Africa’s development. To begin with, part of the AfCFTA's vision is boosting the intra-African trade of goods and services produced within the continent. Low levels of value-added manufacturing in some African countries mean production levels within the continent may struggle to meet the demand the AfCFTA is expected to create. Accelerating the domestic production of goods will require investment; therefore an agency focused on this task holds a lot of value. Linked to this production agenda is the AfCFTA’s mandate to grow regional value chains in Africa, which will require an injection of capital. Given that regional value chains typically involve more than one country, coordinating investment promotion or facilitation activities could be highly beneficial.

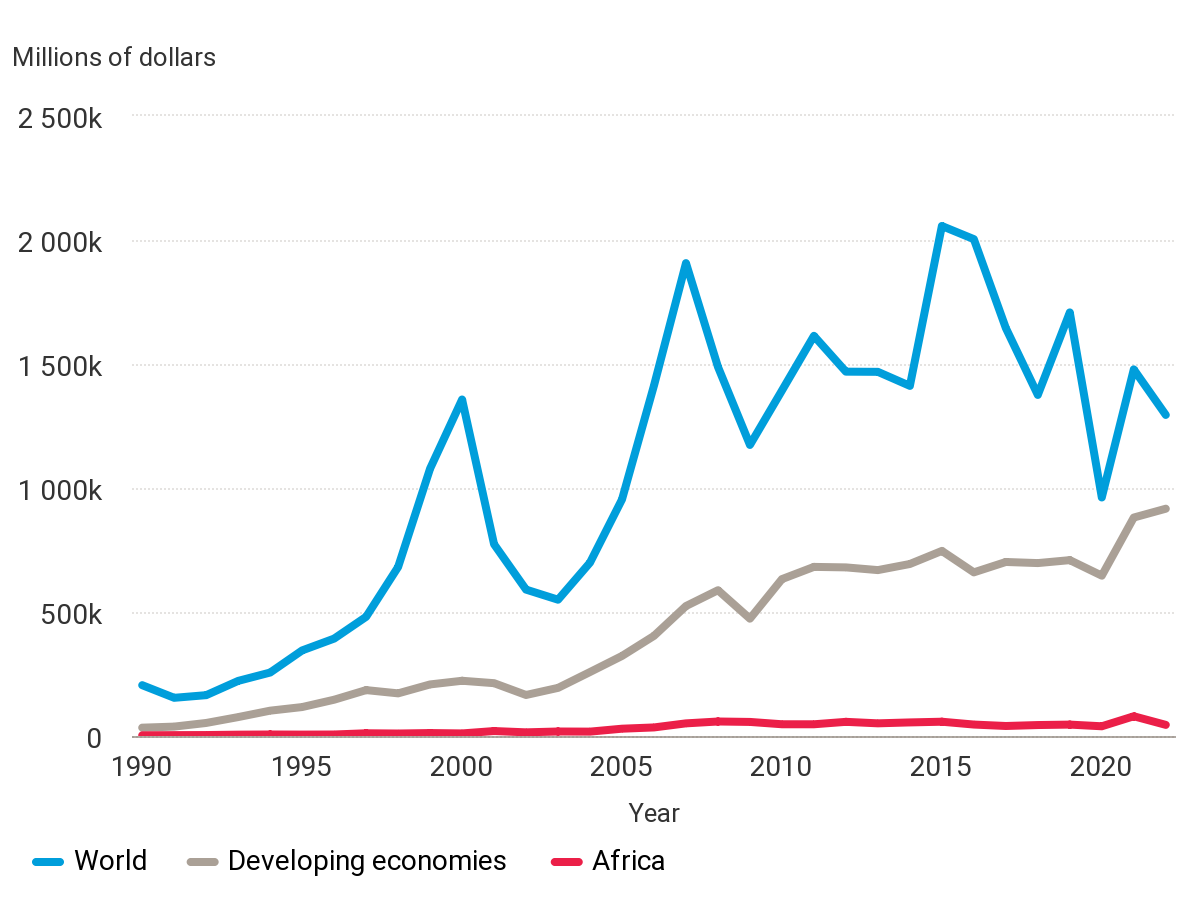

As Figure 1 shows, Africa has struggled to keep up with the growth in global and developing economy foreign direct investment (FDI) flows. Developing economies’ share of global FDI flows increased from 16.4% in 1990 to 70.8% in 2022. However, Africa’s share of FDI flows to developing economies declined from 8.4% in 1990 to 4.9% in 2022. Also, from 2000 to 2022, FDI inward stock into African countries grew by 587.65%, from US$153,062 million to US$1,052,527 million. However, within the same time period, FDI stock for developing economies grew by 899.22%.

National agencies tasked with attracting investment into the continent are faced with numerous challenges in both the internal and external environment. In the internal environment, issues include unstable regulatory and macroeconomic environment, small domestic markets, inadequate infrastructure and skilled labour, conflict and political instability and insufficient government support, among others. External trends such as geopolitical shifts and economic downturns further impact the agencies’ ability to attract investment. Additionally, Africa as a whole suffers from a documented “risk perception gap”, meaning that trade and investment in Africa is seen as riskier than it actually is. This risk perception is further reflected in the cost and availability and tenor of financing for projects across the continent. Finally, recent developments, including the commencement of the AfCFTA, demographic burdens and climate financing needs, make an urgent case for renewed concerted efforts towards attracting investment into Africa.

However, for PATIA to achieve the results that are needed and expected from it, lessons will need to be learned from the successes and challenges of similar initiatives. Currently, there is only one other regional IPA in Africa – the Common Market for Eastern and Southern Africa Regional Investment Agency (COMESARIA). COMESARIA was launched in 2006 and works with the Common Market for Eastern and Southern Africa member states on investment promotion and facilitation issues, particularly on capacity building. The agency has been faced with a number of challenges, including funding and inconsistent support from member states. It has, however, also played a key role in capacity building for national agencies, including training sessions held during the COVID pandemic to support the rebound of investments in the region. In 2001, the United Nations Industrial Development Organization (UNIDO) launched the Africa Investment Promotion Agency Network (AfrIPANet) to help improve the effectiveness of member IPAs in mobilising domestic and foreign investment. Although AfrIPANet has since been replaced by its Invest-in-ACP platform, the experience of its implementation will be a valuable resource for PATIA.

There have also been several other regional investment policies, forums and networks within the continent that have recorded limited success. The challenges and successes experienced by national IPAs, including in the coordination of sub-national agencies, will prove instructive for PATIA. As one example, the Nigerian Investment Certification Programme for States (NICPS) was a programme that was run by the Nigerian Investment Promotion Commission (NIPC) to get a number of Nigeria’s federating states “investor ready”. The programme faced issues, such as the varying capacities at the state level, but was able to successfully support some sub-national IPAs in collating the critical information needed for investment.

Given the above, AfCFTA implementers may consider a number of factors when designing the continental investment agency. Firstly, the agency must be lean. Funding is a major constraint for IPAs around the world and can significantly impact their ability to pursue their mandate. The draft Investment Protocol states that PATIA’s budget will be drawn from the AfCFTA Secretariat’s funding, but it is well known that African Union institutions are mostly financially dependent on external donors. For this reason, any available resources have to be used efficiently for significant returns on spending. More successful IPAs are run almost like private sector enterprises, attracting globally competitive talent and moving with a speed and efficiency that is not generally obtainable in many public agencies. PATIA should also work with this model. The funding structure will have to be sustainable, and consideration should be given to non-public sources of funding.

Secondly, in implementing its mandate, PATIA should emphasise collaboration with national IPAs to avoid being perceived as a competitor for resources. The agency will need to skilfully and strategically navigate the political economy of regional integration in Africa coupled with the inherent competition in investment attraction. There are currently 55 IPAs in Africa, all with national mandates and facing varied domestic realities. PATIA should be regarded as a collaborator and should lean on the existing IPA structures to fulfil its mandate. This approach is already encoded in the investment protocol’s stipulation for the creation of national focal points in state parties (presumably the national IPAs) that will work with PATIA.

Thirdly, the agency will need to be mission-driven, setting clear, achievable targets and focusing on them until they are achieved. A mission-driven agency can align its efforts with the vision for regional value chain development in Africa and work to target, attracting and facilitating investment that will spur the productivity of the value chains. This approach will make it easier to measure PATIA’s success and will allow for timely course correction.

Linked to the above point is the investment protocol’s emphasis on ‘sustainable investment’, placing a burden of responsibility on potential investors. Leveraging on the global shift towards sustainability will be beneficial to AfCFTA state parties, and PATIA can play a role in attracting these investments. Investments into renewable energy dominated FDI inflows in 2022, a trend that is particularly important for African countries currently facing energy transition. PATIA can therefore play the role of guiding national IPAs on sustainable investment attraction, as this is an area in which many are not yet experienced.

Finally, although not explicitly stated in the investment protocol, it will be beneficial if PATIA also takes on the challenge of promoting a more accurate image of the African investment landscape to domestic and foreign investors. Although investment in Africa is not without its challenges, there is an observed gap between the risk perceptions of investors not yet on the continent and those with established operations. PATIA should therefore help to promote a more positive image by highlighting successful investment stories in Africa and debunking “myths” about Africa that are often perpetuated in the media. It should also be the main vehicle to promote the abundant, new multi-country investment and trade opportunities that AfCFTA is creating.

To successfully establish PATIA, the AfCFTA Secretariat will need to be supported by other African multilateral institutions such as the African Development Bank, the African Export-Import Bank and the African Finance Corporation, pooling resources and expertise to achieve its mandate. By working alongside national investment promotion agencies and focusing on sustainable investment and pan-African challenges, PATIA will be well positioned to address some of the existing barriers to investment on the continent. However, its success will hinge on having a focused, achievable mandate, learning from past regional initiatives, securing sustainable funding and fostering effective collaboration. As PATIA develops, it holds the promise of not only attracting essential capital but also promoting a positive narrative about investing in Africa, concretely supporting the realisation of the AfCFTA's broader vision of boosting intra-African trade and fostering economic integration.

Teniola T. Tayo is a policy advisor with a focus on regional integration issues in Africa including the African Continental Free Trade Area and wider trade, investment and development policies on the continent. She is currently the Trade Policy Fellow at the Africa Policy Research Institute.

Keith Martin has been working on project finance, risk mitigation and investment promotion in Africa, Latin America, the Middle East and Central Asia for over 25 years. Working with the AfDB’s Initiative for Risk Mitigation in Africa, he supported governments and private sector entities in efforts to promote investments, financing and PPP structures through better identification and structuring of risks. These activities took place in Cabo Verde, Egypt, Kenya, Madagascar, Mozambique and Senegal, among others. He currently serves on the Investment, Risk and Credit Committee of the AfDB’s Private Sector Credit Enhancement Facility.