About the Series

APRI is actively generating knowledge and shaping debate on key topics related to energy and climate diplomacy, aiming to strengthen the relationship between Europe and Africa. The Green and Transition Minerals Collection provides in-depth African perspectives, empowering policymakers to leverage resources essential for Europe's energy transition and Africa's industrialization.

Introduction

This paper provides a brief analysis of the prospects for the development and integration of African battery mineral value chains (BMVCs) to support the green transition. African countries have outlined ambitions to industrialize (Chang et al., 2016), including by adding value to their mineral endowments in various documents and fora. These include the 2009 African Mining Vision, the ongoing process to finalize an African Green Minerals Strategy and the 2023 Nairobi Declaration (African Union, 2009; ANRC, 2022; AHOS, 2023). The central questions is: How can African countries achieve the objective of adding value to battery minerals and building integrated value chains?

Prospects for BMVC development and integration are set within the global context of the green energy and digital transitions, which have spurred a race to secure the critical minerals (CMs) required for these transitions (Andreoni & Roberts, 2022). This race is fueled by the strategic intent of the United States (US) and Europe Union (EU) to catch up with China’s industrial and technological lead in various green and digital technologies, thereby reducing their dependency on Chinese-dominated value chains.

Many African countries are heavily dependent on exporting fossil fuel energy products or minerals. To avoid repeating historical patterns of exporting low value-added primary resources, African countries must strategize – both individually and collectively – to maximize the value of their battery mineral endowments and capabilities (Lopes, 2023; Lebdioui, 2024). Similarly advanced economies seeking secure supplies of CMs (including the US, EU, Japan, South Korea and the United Kingdom (UK)) need to evolve their strategies. They must move beyond the historical “pit to port” model, with its strong colonial associations to mutually beneficial models that align with African ambitions to add value to their CMs endowments.

Section 2 of this paper sets out global developments in battery markets and technology that shape the prospects for African countries aiming to build BMVCs. Section 3 discusses the extent and nature of Africa’s battery mineral resources, identifies some macroeconomic implications of the shift from fossil fuels to transition minerals, and outlines key factors that support or hinder the development of African BMVCs. Section 4 unpacks selected recent battery mineral investments and commitments across various African countries. Section 5 identifies potential policy options for African countries to develop BMVCs at the national level, and, more challengingly, to foster regional BMVC integration. Section 6 draws conclusions and points to areas for further research and data collection related to deepening BMVCs.

1.

Global developments in battery markets and technologies

Over the last decade, lithium-ion (Li-on) batteries have become the predominant battery technology due to their higher energy densities and longer life cycles compared to older lead acid and nickel-cadmium battery technologies. As discussed below, there are different competing Li-ion battery chemistries, as well as potential new generation battery technologies emerging (IEA, 2024).

In this period, demand for Li-ion batteries has been overwhelmingly driven by their increasing use in electric vehicles (EVs). The global EV market has experienced explosive growth, reaching 45 million units by 2023, led by Chinese demand.

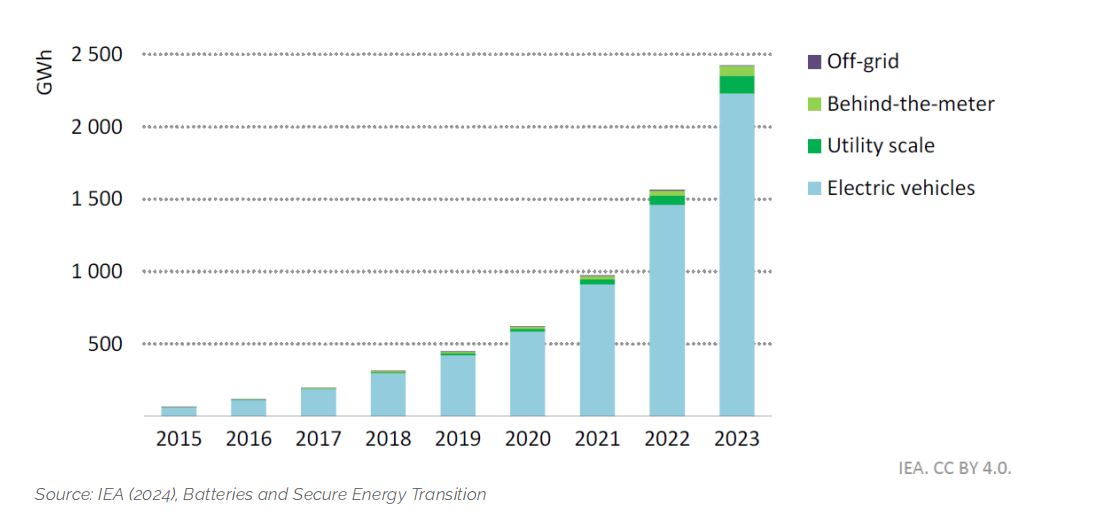

EVs accounted for over 90% of the growth in battery demand between 2015 and 2023 and continue to dominate total battery demand (Figure 1). However, demand for battery energy storage systems (BESS), while still below 10% of total battery demand, has accelerated rapidly. BESS demand grew by 100% in 2023, compared to a 40% increase in EV demand. BESS applications include utility-scale storage to address intermittency and variability in solar and wind energy, behind-the-meter batteries, mini-grids and solar home systems. Meanwhile, the relative contribution of demand for Li-ion batteries for consumer electronics has fallen (IEA, 2024).

Source: IEA (2024), Batteries and Secure Energy Transition

Batteries for EVs need to be as energy dense, small and light as possible, with intensive technological efforts and expenditure to achieve improvements on all three fronts. Batteries for storage have less rigorous size and weight requirements, with an emphasis on endurance and low cost. The increasing pace of growth in BESS-related applications may open up opportunities for regional assembly, fabrication, linked services and reuse and re-cycling in Africa.

The rapid increase in EV demand and production has been and continues to be driven by a mix of industrial policy and regulatory measures. China leads on both the consumption and production fronts, as the largest market for and producer of EVs. Advanced economies are responding by introducing a raft of measures to support their own EV and battery mineral production, including subsidies, regulatory measures such as a looming ban on internal combustion engine (ICE) vehicles in Europe and other markets, trade measures and consumer subsidies bolstered by a shift in consumer sentiment away from ICE vehicles (Dempsey et al., 2023).

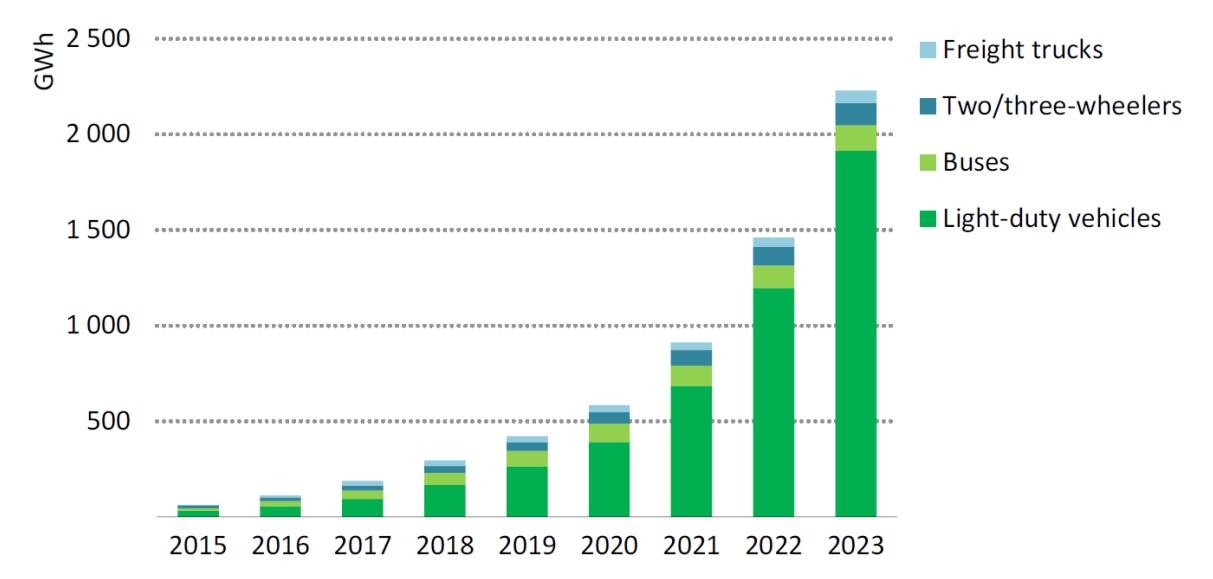

Amongst EV’s, light-duty vehicles have had the highest growth between 2015 and 2023 (Figure 2). Similar to batteries for storage, buses, two and three wheelers and freight trucks have grown rapidly over the last few years, albeit off a low base. The increasing pace of growth for two and three wheelers and buses might introduce opportunities for a regional approach to assembly within and for the African region.

Source: IEA (2024), Batteries and Secure Energy Transition

Click on the figure to open a zoomed-in modal view.

Li-ion batteries are currently by far the dominant set of battery technologies, with the battery accounting for approximately one third of the cost of an EV. The Li-ion battery value chain comprises the following major stages:

- Upstream mineral extraction and processing involves mining of battery minerals like lithium, cobalt, graphite, nickel, manganese and phosphates. Thereafter, minerals undergo crushing, grinding and separation. These activities require relatively low to intermediate technological capabilities and may represent “low hanging fruit” for African countries to add value.

- More sophisticated stages of processing involve the transformation of minerals into high purity precursor materials through refining, smelting, and electrolytic and chemical processing. These are both capital and energy intensive processes, with adequate electricity supply potentially a constraint.

- Mid-stream processing, arguably the most complex stage, involves manufacturing of the battery cells themselves from precursors, combining cathodes, anodes, electrolytes and separators.

- Downstream processing commences with the assembly of cells, housing structures and battery management systems into battery packs. Battery packs feed into the assembly of EVs or BESSs. Assembly of batteries for BESSs and EVs from imported cells and components is a potential entry point into the value chain. A still-emerging downstream activity is the “second life” reuse of batteries or their recycling to extract valuable CMs for new batteries (Table 1).

Table 1: Lithium-ion battery value chain

| Stage | Process | Description |

|---|---|---|

| Upstream | Mining of Battery Minerals | Extraction of raw materials from open cast and underground mines, notably:

|

| Upstream | Processing: low to intermediate capabilities | Crushing, grinding and separation

|

| Upstream | Refining of Precursor Materials: sophisticated capabilities | Refinement and processing of raw materials into high-purity chemicals through smelting and refining, electrolytic and chemical processing to produce:

|

| Midstream | Battery Cell Production | Manufacturing of battery cells comprising:

|

| Downstream | Battery Pack Assembly | Assembling battery cells into packs for use in EVs and energy storage systems:

|

| Downstream | End Users - EV Applications | Electric vehicle assembly:

|

| Downstream | End Users - Storage Applications | Assembly of battery packs for energy storage systems, supporting grid stability and renewable integration. |

| Downstream | Battery reuse and recycling | “Second life” reuse and recovery of battery minerals through metallurgical processes |

Sources: Compiled by author based on Karkare and Medinilla (2023), Electriqz (2023), and Visual Capitalist (2024).

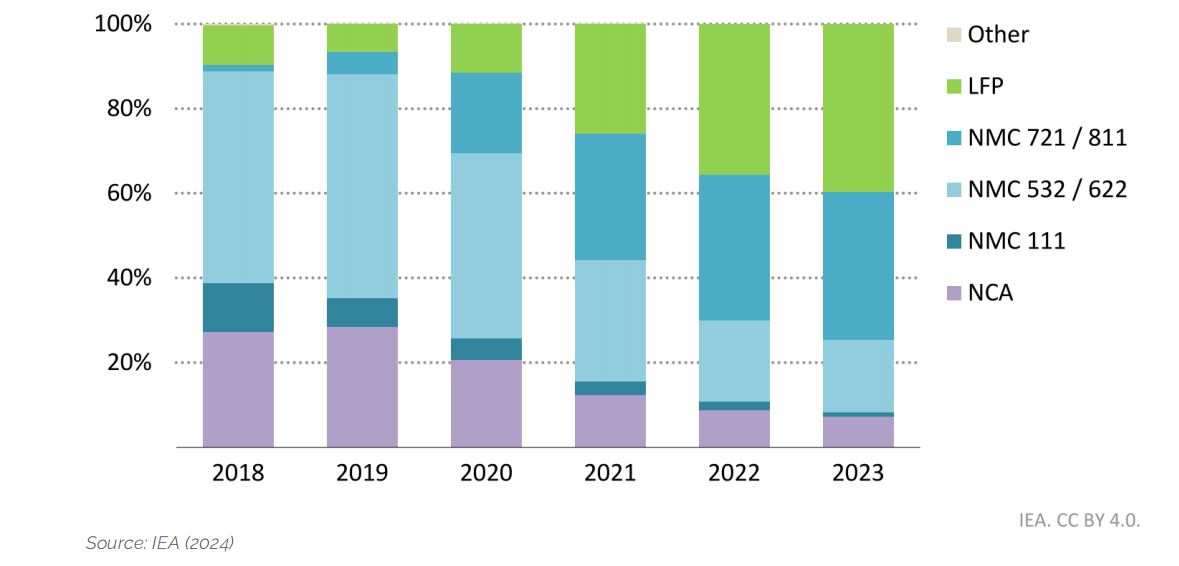

Two EV battery technologies predominate: lithium, iron and phosphate (LFP); and lithium, nickel, manganese and cobalt (NMC) variants (Figure 3) (Dempsey et al., 2023). China dominates overwhelmingly in LFP batteries, which in turn are installed in Chinese EV vehicles that are leading growth in global sales, predominantly for the Chinese market itself. Chinese companies CATL and BYD together account for around 50% of global battery production, followed by South Korea’s LG and Samsung and Japan’s Panasonic (White et al., 2023). The increasing share of LFP relative to NMC batteries is reflective of the rapid growth and rising share of Chinese produced EVs.

Source: IEA (2024)

Click on the figure to open a zoomed-in modal view.

Alternative battery chemistries and technologies are being developed but remain at a nascent stage, such as solid-state, and sodium-ion batteries and vanadium flow redox batteries for stationary storage applications. Alternate electricity and energy storage technologies, such as fuel cells, are beyond the scope of this paper but appear to be unlikely to compete with batteries in the immediate future (Mckinsey & Company, 2024).

Globally the battery-to-EV value chain is characterized by high levels of concentration, both “horizontally” at each stage of the value chain and vertically across multiple value chain stages. BHP, Vale, Glencore and Rio Tinto together with Huayou dominate mining. Only Huayou goes on to produce battery materials. Other major battery material producers include LG Chem, EcoPro, Ronbaby, Umicore, Yunnan New Energy and Putailai. Chinese company BYD is uniquely vertically integrated from battery materials production right through to car production. Other major battery cell makers include CATL, Panasonic, Nissan/AESC and Tesla. CATL also produces battery packs, while Nissan/AESC is vertically integrated through to car production. Tesla is vertically integrated from battery cell production through to car production and on to distribution. BMW, BAIC and VW produce both battery packs and vehicles. Yutong, and Zhongtong are dedicated EV manufacturers. Umicore, Glencore, Accurec and AkkuSer are major players in battery recycling (Campbell et al., 2023).

The overarching global picture is that China dominates the world share of processing of major battery minerals, including lithium (58%), cobalt (65%) nickel (35%) and copper (40%)(Venditti, 2022). On the African continent, Chinese mining companies have had a growing, albeit uneven, presence in the extraction of battery and other CMs (Andreoni & Roberts, 2022).

2.

Africa’s battery mineral resource endowment

African countries hold approximately 30% of the world’s proven reserves of CMs, with particularly high shares of certain battery minerals. This includes 71% of global cobalt reserves, 42% of manganese, 22% of graphite and 13% of vanadium (Table 1). Nickel production across several southern African countries is substantial (South Africa, Madagascar, Zimbabwe and Zambia) (EMIS, 2024). Zimbabwe’s relatively recent commencement of lithium extraction is set to grow, and the country is already the world’s sixth largest producer of lithium (EMIS, 2024).

Table 2: Selected African Battery Mineral Resources

| Mineral | Country | Reserves (tonnes), 2023e | Share of Global Reserves, 2023e | Global Rank by Reserves, 2023e | Share of Global Mine Production, 2023e | Global Rank by Production, 2023e |

|---|---|---|---|---|---|---|

| Bauxite | Guinea | 7,400,000,000 | 24.7% | 1st | 23.5% | 2nd |

| Cobalt | DRC | 6,100,000 | 54.6% | 1st | 74.9% | 1st |

| Madagascar | 100,000 | 0.9% | 4th | 1.7% | 6th | |

| Morocco | 23,000 | 0.2% | 7th | 1.3% | 9th | |

| Copper | DRC | 31,000,000 | 2.9% | 12th | 10.7% | 3rd |

| Zambia | 22,000,000 | 2.0% | 17th | 3.3% | 7th | |

| Graphite | Mozambique | 24,000,000 | 6.1% | 4th | 6.4% | 4th |

| Tanzania | 18,000,000 | 4.6% | 6th | 6.0% | 5th | |

| Lithium | Zimbabwe | 600,000 | 3.7% | 5th | 7.6% | 6th |

| Manganese | Ghana | 390,000,000 | 6.9% | 2nd | 2.4% | 9th |

| Ivory Coast | 35,000,000 | 1.7% | 5th | 1.1% | 13th | |

| PGM | South Africa | 63,000 | 70% | 1st | 78.7% | 1st |

| Zimbabwe | 1,200 | 1.7% | 3rd | |||

| Palladium | South Africa | 35.8% | 2nd | |||

| Zimbabwe | 16.1% | 5th | ||||

| Platinum | South Africa | 60.7% | 1st | |||

| Zimbabwe | 10.1% | 3rd |

Source: EMIS 2024, based on United States Geological Survey (USGS)

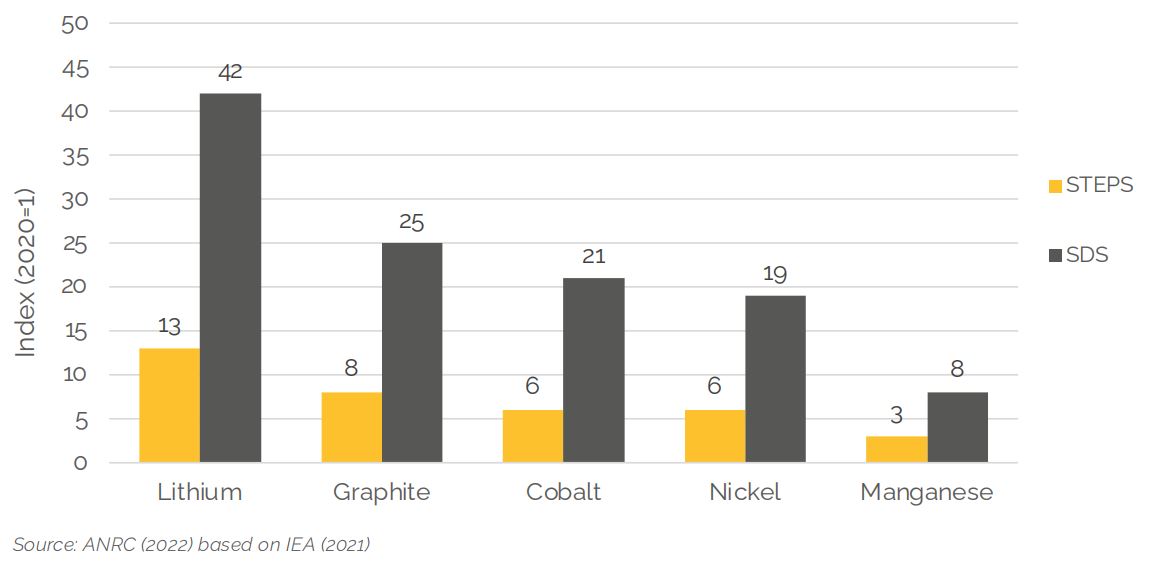

The Africa Natural Resources Management and Investment Center (ANRC) of the African Development Bank (AfDB) estimates dramatic increases in global demand for various battery minerals by 2040, representing a very clear opportunity for African countries to scale up their mining and processing of battery minerals to meet this demand. The range of anticipated demand increases is based on two scenarios. The lower end of the range is based on a “stated policies scenario” (STEPS), essentially demand that will arise if countries implement their nationally determined contributions under the 2015 Paris agreement. The higher “sustainable development scenario” (SDS) is based on countries achieving emissions reductions from 2030, with net zero achieved by 2070 (Figure 4). The two scenarios are based on the International Energy Agency (IEA) projections but adjusted for improvements in mineral intensity use. Projected demand increases between 2022 and 2040 range from 130%-420% for Lithium, 80%-250% for Graphite, 60%-210% for Cobalt, 50%-190% for Nickel and 30%-80% for Manganese (ANRC, 2022).

Source: ANRC (2022) based on IEA (2021)

Click on the figure to open a zoomed-in modal view.

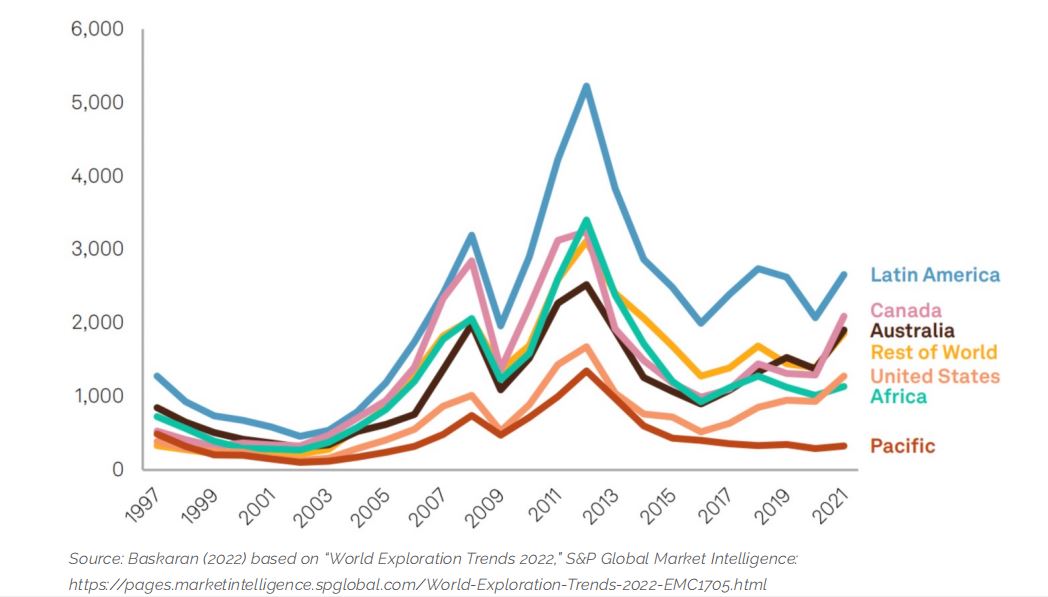

Furthermore, recorded reserves of African CMs are likely to underestimate the continent’s endowment due to low levels of mining exploration expenditure in areas with similar geological structures to those where proven reserves are located (Ahadjie et al., 2023). Mining exploration budgets for all African countries combined have declined since 2011 and, over recent years, have been lower than those of Latin America and some individual countries such as Canada and Australia (Figure 5). Increasing mining exploration expenditure is thus important to expand the identification of viable reserves.

Source: Baskaran (2022) based on “World Exploration Trends 2022,” S&P Global Market Intelligence: https://pages.marketintelligence.spglobal.com/World-Exploration-Trends-2022-EMC1705.html.

Click on the figure to open a zoomed-in modal view.

The shift in demand from fossil fuel mineral and energy products to transition minerals will have profound macroeconomic implications for African countries. As captured by the IMF, there are not only significant potential gains from extracting and processing of CMs but also associated macroeconomic risks in the shift away from fossil fuels (IMF, 2024). In aggregate terms, sub-Saharan African countries are projected to experience a sharp decline in real terms in exports and fiscal revenues from the extraction of fossil fuels (oil, natural gas and coal), from USD 3.523 trillion (EUR 3.22 trillion) over the period 1999-2022 to USD 625 billion (EUR 572 billion) between 2024-50. Conversely, revenue from major battery minerals (copper, nickel, cobalt and lithium) are estimated to increase from USD 297 billion to USD 1.934 trillion (EUR 272 billion to EUR 1.77 trillion) over the corresponding periods.

Table 3: Sub-Saharan Africa: Estimated cumulated real revenues from production of selected CMs and fossil fuels, 2024–50 technologies in Africa

| Historical, 1999–2022 | Under Net Zero Scenario, 2024–50 | |||

|---|---|---|---|---|

| (2023 Billion US$) | (SSA Percent of World Total) | (2023 Billion US$) | (SSA Percent of World Total) | |

| Selected Minerals | 297 | 8 | 1,934 | 12 |

| Copper | 200 | 8 | 662 | 10 |

| Nickel | 38 | 5 | 293 | 5 |

| Cobalt | 56 | 54 | 880 | 66 |

| Lithium | 3 | 3 | 99 | 5 |

| Fossil fuels | 3,523 | 5 | 625 | 3 |

| Oil | 2,805 | 5 | 508 | 2 |

| Natural gas | 279 | 2 | 52 | 4 |

| Coal | 438 | 4 | 65 | 3 |

Source: IMF (2024) p3

African countries will be unevenly impacted by this transition. Fossil fuel-dependent exporters will be major losers in the green transition, while countries with large deposits of CMs stand to benefit. However, the projected revenue increases from the extraction of major battery minerals will not offset the fiscal revenue losses from lower fossil fuel demand and the accompanying sales and export earnings underpinning these revenues. This adds to the imperative for greater processing of CMs on the continent. Thus:

[by] sticking to the lower value-added stages of extraction, countries risk losing substantial benefits from processing. Developing local processing industries could significantly boost profits, increase tax revenues, create higher-skilled jobs, and enhance positive technological spillovers.

(IMF (2024), p4)

African countries will also need to manage price volatility and periods of supply-demand imbalance, such as those experienced in 2023 when the price of lithium fell by 80% as new supply came onstream (Cohen 2023). This will require states to develop long-term outlooks and foster patient capital to navigate these waves of volatility.

Broadly speaking, a number of factors influence the ability of African countries to add value to battery minerals and build integrated battery value chains, both positive and countervailing.

Supportive factors include:

- Rising and sustained demand for battery minerals, driven primarily by the rapid growth in demand for EVs, but increasingly by growth in demand for stationery BESS systems.

- The presence of existing and potential CM deposits, particularly where African countries individually or collectively have a high enough global share to influence supply and hence encourage further processing before exports.

- Lessons learnt from other developing countries that, notwithstanding China’s dominance in processing of BMVCs beyond the mining stage, development is possible. Lessons can be derived from experiences of countries that include Indonesia, Chile and Morocco, which have managed to a greater or lesser extent to develop significant BMVC manufacturing capabilities. These include both the types of policy instruments that can be used under differing circumstances as well as the pitfalls to avoid in promoting BMVC development.

- Shifting geopolitics and the “race for critical minerals” open up potential opportunities that African countries can pursue. As discussed below, Morocco has effectively combined accumulated industrial capabilities and access to the EU and US markets to develop automotive assembly on the one hand and upstream battery mineral processing on the other. As argued by Baskaran, the US should back its high-level statements of commitment to the development of CM processing on the continent by opening up access to IRA benefits to AGOA countries (Lopes, 2023).

- The desire by the US and EU for greater supply chain diversification to limit reliance on Chinese battery mineral processing and manufacturing presents an opportunity to attract investment. This includes the attraction of Chinese investment in battery mineral processing for the US and EU markets, as a hedge against the risk that direct exports from China will become more constrained.

Countervailing factors include:

- African countries are at the very early stages of the e-mobility revolution, with associated low levels of demand on the continent. Most African countries, therefore, do not enjoy proximity to high growth markets.

- Competitive participation in the battery value chain requires investment at high minimum economies of scale across most segments. Subsidies and other forms of state support have been instrumental in building the dominance of Chinese firms in the battery and EV value chains, and in the US and EU’s recent responses to claw back industrial and technological market share.

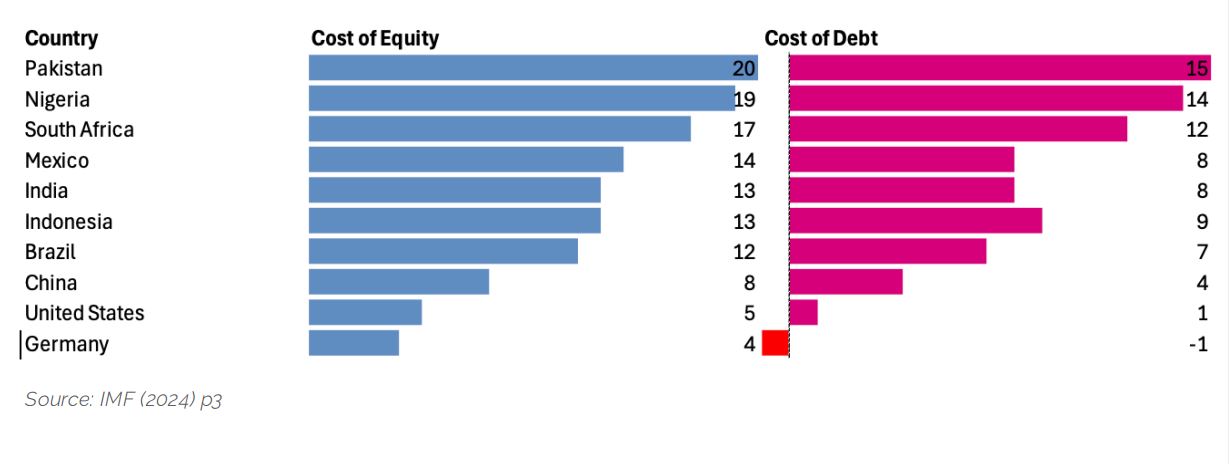

- High debt levels limit African countries’ ability to use fiscal instruments to support their green transition. Ratings agency-led perceptions of high-risk levels mean the cost of capital for African countries is high. The weighted average cost of capital (WACC) for capital-intensive projects (like chemicals, cement, steel and renewables projects) is lowest in advanced economies, followed by China. The WACC for other emerging and developing countries is considerably higher, typically double or more than advanced economy levels. Countries that fall into the latter category include, but are not limited to, African countries. Nigeria and South Africa have equity and debt costs at the higher end of comparator countries (Figure 6).

- Corruption, other forms of unproductive rent seeking, and large unpredictable policy shifts are significant risk factors in certain African (and other) jurisdictions (Karkare, 2024).

Source: IEA (2021)

Notes: Cost of Equity: Indicators of economy-wide cost of capital for equity (government bond + equity risk premium), nominal values, 2016 and 2020. Indicators of economy-wide cost of capital for debt (government bond + debt risk premium), nominal values, 2016 and 2020

Click on the figure to open a zoomed-in modal view.

3.

Recent BMVC developments in Africa

The development of battery mineral value chains on the continent beyond mining is, for the most part, limited. However, there have been a number of recent BMVC-related investments and high-level statements of intent to support BMVC investment by the US and EU.

Morocco is the most advanced on the continent in building major pillars of an integrated BM/EV value chain. This is a function of building on the combination of pre-existing resource endowments and industrial capabilities and taking advantage of market access to the EU and US. Morrocco’s approach is informed by its Industrial Acceleration Plan for the automotive industry and Morocco Mines Plan.

Morocco has established itself as a major automotive assembler on the continent, largely through attracting investment from French OEMs Renault, Peugeot and Citroën (Tanchum, 2022). In less than 15 years, Morocco has grown its automotive assembly from around 50,000 vehicles in 2010 to 535,825 in 2023, bringing it close to the volumes of the more established assembler South Africa (producing 633,337 vehicles) (CEIC Data, (n.d. a,b). Morocco has begun to enter the EV space to supply the burgeoning EU market, impelled by the imminent ban on ICE vehicles by 2035. It produces around 50,000 EVs a year (Wuttke, 2022).

At the upstream end of the value chain, a slew of battery-related investments, overwhelmingly Chinese, have been announced for precursor materials required to produce both NMC and LFP batteries. This builds on Morocco’s position as the world’s second largest phosphate producer, holding 70% of the world’s reserves. LFP batteries economize on expensive cobalt and nickel with cheaper phosphate and iron (Tanchum, 2022). China’s CNGR Advanced Material announced its intent to build a cathode materials plant in Morocco to supply both the US and European battery markets. In 2023, South Korea’s LG Chem and China’s Huayou Cobalt have announced a joint venture to build a Moroccan lithium refinery and cathode materials plant (Dempsey, 2023. China Baoan Group subsidiary BTR New Material Group has announced a USD 500 million (EUR 457 Million), 50,000-ton, cathode plant (‘BTR to Invest in Cathode Plant in Morocco’. 2024). Hunan Zhongke’s Shinzoom subsidiary has announced a USD 460 million (EUR 421 million) anode plant investment (Elijechtimi, 2024). Hailiang plans to build a USD 450 million (EUR 412 million) copper plant. Morocco’s strategic intent to fill the critical value chain gap between battery materials and EVs is demonstrated by a Memorandum of Understanding (MOU) with China’s tenth-largest battery producer, Gotion, to explore a USD 6.4 billion (EUR 5.85 billion) 100-gigawatt battery plant (Africa Investment Forum, 2023).

South Africa, although it is the most industrialized economy on the continent, lags behind Morocco in the battery mineral to EV value chain. South Africa’s automotive sector does not yet produce any EVs (although Toyota produces a hybrid Corolla Cross). South Africa’s Electric Vehicles White Paper policy was only launched at the end of 2023 (DTIC, 2023) and a Critical Minerals Strategy is yet to be formulated (Mantashe, 2024).

However, South Africa has substantial battery mineral resources and has developed significant mining and industrial capabilities that are applicable or potentially transportable to the BMVC.

South Africa has a long history of mineral processing and a correspondingly long, albeit uneven, history of mineral processing research and development. These processing capabilities have been historically linked to serving the needs of the gold, platinum group metals (PGMs) and ferro-alloy industries. An Energy Storage Research, Development and Innovation consortium has been running since 2011, with a number of industry partnerships. However, progress appears limited in translating this R&D into commercial projects, the reasons for which are unclear. One general constraint to energy-intensive mineral processing has been South Africa’s electricity crisis and rolling blackouts since 2008 or “loadshedding” together with enormous increases in the cost of electricity.

Upstream, South Africa holds about 80% of the world’s reserves of manganese, essential for NMC batteries. Ongoing battery research and development seeks to lower the cobalt content of NMC batteries by substituting with a higher share of manganese, a potential supply boost for the mineral. South Africa’s global production share of manganese is 45% implying an opportunity to increase production to close the reserve-production gap (Creamer Media, 2023). While South Africa does process some manganese into alloys it does not currently produce battery grade manganese. Over 80% of ore is exported unprocessed. Manganese processing remains overwhelmingly directed towards the production of ferro-manganese and alloys linked to domestic and export steel industry requirements. Manganese Metal Company (MMC) stands out as the producer of the world’s purest manganese (at a purity level of 99.9%). It has announced a project to produce battery-grade manganese sulphate (TIPS, 2021). This is illustrative of the kind of shift that South African mineral processors could make towards producing battery mineral precursors.

South Africa also has deposits of other battery relevant minerals, although not necessarily at a globally significant scale. This includes nickel, phosphate rock and titanium (battery grade titanium feeds into LTO batteries – a lithium, titanium and oxide variant) and copper. Similar to manganese processing, the processing of these minerals is directed towards pre-existing industrial uses and markets rather than emerging battery mineral applications. South Africa also produces aluminum from imported bauxite. Semi-fabricator Hulamin supplies the US market with fabricated products for EV batteries (Hedley, 2023).

A significant number of firms assembling battery packs from imported cells for the BESS market have been established, including capabilities in battery management systems and components. Assemblers focus on serving the light industrial and commercial sector in South Africa and elsewhere on the continent. Some small- to medium-scale specialized e-mobility assemblers have sprung up, focusing on end uses such as “last-mile” e-commerce delivery. Bushveld Energy is developing a local vanadium redox flow battery, suitable for large fixed industrial applications.

Despite its late start, South Africa has the potential to utilize its battery mineral endowments and existing industrial capabilities to become an integrator for the development of a BVMC in the Southern African region. This could involve supporting an equitable distribution of battery mineral processing activity in nearby countries linked to their specific endowments, drawing on South Africa’s expertise. South Africa and, to some extent, Zambia, have opportunities to benefit from “side stream” linkages through the supply of mining capital equipment and services to the burgeoning southern African CM mining and processing sector.

The DRC and Zambia are the continent’s largest copper producers, together accounting for nearly 14% of global production in 2023. Most copper mines in the DRC are owned by Chinese mining companies, followed by commodity trader Glencore. In Zambia, leading producer Canadian First Quantum Minerals owns the two largest copper mines: Sentinel and Kansanshi, while Barrick Gold owns the Lumwana mine. China Non-Ferrous Metals Mining has stakes in several mines, including Mwambashi, Chambishi, and Muliashi. Zambia’s state-owned ZCCM Investments holds equity in many major mines and took control of Mopani, the country’s fifth-largest mine, from Glencore in 2021. UAE’s International Resources Holdings was appointed strategic equity partner in Mopani in late 2023, reportedly committing to invest $1.1 billion for a 51% ownership stake (EMIS, 2024).

In December 2022, the US, DRC and Zambia signed an MOU to jointly develop an EV battery supply chain (Burger, 2023). This was followed by an October 2023 MOU between the United States of America, the DRC, the Republic of Zambia, the Republic of Angola, AfDB and the Africa Finance Corporation to develop a Trans-African Corridor connecting the mining areas of the southern Democratic Republic of the Congo and northwestern Zambia to international shipping routes via the Angolan Port of Lobito (Soulé, 2023). Part of the MOU involves a statement of intent to support the establishment of dedicated industrial parks in both Zambia and the DRC for the processing of cobalt and copper. It is unclear, however, what the progress is with these industrial parks.

These MOUs have been signed under the auspices of the G7 Partnership for Global Infrastructure, widely considered to be a belated western response to China’s Belt and Road Initiative at the Global Gateway Forum in October 2023. Concurrently, an USD 850 million (EUR 778 million), Chinese-funded infrastructure project is underway to connect the Zambian and DRC copper belt to Tanzania’s Indian Ocean port in Dar es Salaam (Karkare & Medinilla, 2023).

A number of African countries have lithium resources, at different scales. Mining of recently exploited resources has catapulted Zimbabwe to become the 6th largest producer in the world. Chinese companies bought controlling stakes in 2022 of two of Zimbabwe’s three largest mines. Zhejian Huayou Cobalt and Sinomine Resource Group have acquired the Arcadia and Bikita mines respectively. UK-domiciled Premier African Minerals owns the Zulu mine. In 2022, the Zimbabwean government banned all exports of lithium not processed to the concentrate stage (EMIS, 2024). In 2023, Prospect Lithium Zimbabwe, a Zhejiang Huayou Cobalt subsidiary, built a $300m concentrate plant to process 4.5 million metric tons of hard rock lithium into concentrate for export per year. Sinomine began building a 300,000 metric tons spodumene concentrate plant. Premier has stated its intent to build a 50,000 metric ton lithium spodumene concentrate plant (Banya, 2023). However, these projects do not meet the Zimbabwean government’s objectives of producing battery-grade lithium carbonate. Miners have cited the 2023 fall in lithium prices and electricity supply constraints as barriers to meeting this ambition (Banya & Chingono, 2023). Namibia, Ghana, the DRC, Ethiopia and Mali have also identified smaller deposits of lithium. Namibia and Ghana both announced prohibitions on unprocessed lithium and other CMS in 2023. In addition to lithium, Namibia has deposits of copper, uranium and rare earths while Ghana counts bauxite and iron amongst its strategic minerals (EMIS, 2024).

The world’s eighth largest cobalt mines are situated in the DRC’s Katanga mining region. Chinese enterprises have a significant presence, with CMOC Group's Tenke Fungurume mine, China Railway Group's Sicomines Copper-Cobalt mine and Jinchuan Group's Ruashi mine among the largest producers. Kazakh-owned Eurasian Resources Group subsidiary Metalkol is the world's largest cobalt mine. Swiss commodity trader Glencore operates the KOV, Mutanda, and Mashamba East mines, which are ranked fourth, fifth, and sixth in production, respectively. Dubai-based Shalina Resources owns the Etoile mine. Other than the DRC, Madagascar, Morocco and Zambia also have cobalt deposits. In Madagascar, the Ambatovy mine complex, is jointly owned by Japan's Sumitomo Corporation and South Korea's Komir. The major operating cobalt mines in Zambia are the Mwambashi mine, the Muliashi Project, the Baluba Center mine and the Chambishi Southeast Project, all owned by Chinese companies (EMIS, 2024).

Africa is the second largest supplier of graphite after China, accounting for a quarter of global production. Its importance as a supplier has been enhanced by China’s introduction of export restrictions on some graphite products. Madagascar is the world’s second largest supplier followed by Mozambique and Tanzania. Canadian NextSource owns Madagascar’s largest mine, Molo. London Stock Exchange (LSE)-listed Tirupati Graphite owns the Vatomina and Shamamy mines. Australian Evion Group is developing the Maniry mine. Australian companies are the main developers of Tanzania’s graphite deposits: Black Rock Mining, EcoGraf, Evolution Energy Minerals, Magnis Resources, Volt Resources and Walkabout Resource. Evolution, EcoGraf and Peak Rare Earths mine both rare earths and graphite (EMIS, 2024). Mozambique’s graphite mines are operated by Australian Syrah Resources and Triton Metals, Germany’s AMG Graphit Kropfmuehl and Tirupati.

One significant constraint in fully analyzing BMVC developments on the continent (and elsewhere) is informational. There can be significant uncertainty about the extent to which high level announcements of MOUs, and even specific projects, translate into operational projects. The ability to raise funding, project delays and changes in corporate strategy and investment decisions all introduce uncertainty into ultimate project completion. This raises the desirability of establishing research capacity for ongoing tracking of projects from announcement to construction and production stages.

However, the general picture is of limited BMVC integration on the continent with most activity concentrated at the two poles of the value chain. Notably, there is very limited intra-regional value chain integration. Rather, integration largely takes place through a foreign investment and export model. However, the example of countries including Morocco indicates that BMVC development is indeed possible and provides useful lessons on how (and how not) to pursue this objective at the national level. As discussed below, developing regional integration adds an additional layer of complexity.

4.

Indicative policy implications and options

Building BMVCs on the continent from mining through to such as EV and BESS presents a formidable challenge. However, it is not an impossible one. African countries need to tread a careful line between two binary positions.

The first is that, notwithstanding the forceful reemergence of industrial policy and protectionist trade measures by advanced economies, African countries should refrain from interventionist measures and focus on “good governance” and infrastructure development in the hope that this will attract investment in further processing of CMs. The second is a naïve or mechanistic view that crude restrictions on CM exports are sufficient to mobilize investments in downstream value chain investment.

There are various policy options available at the national level to build value chains with foreign partners, whether they are Chinese, or Western (including Japan), or both. The most complex challenge is to build regionally integrated value chains. This is desirable as no single country has all the natural resources necessary, and there are varying degrees of industrial capabilities between the most and least industrialized African economies.

At the national level, governments have a range of policy instruments at their disposal that can be calibrated to feasible BMVC opportunities, considering specific conditions, including mineral deposits, existing levels of industrial capability development and the navigation of powerful interests. The suite of policy instruments available spans geopolitical positioning, minerals policy, trade and industrial policies, development banks and macroeconomic instruments.

In the context of a global race to secure the supply of CMs, African countries can leverage an international relations posture of ‘strategic non-alignment’, focusing on what is in their own strategic interests, rather than ‘picking sides’ in geopolitical contestation.

Mining policy can be deployed to create an environment that enables investor certainty which is necessary to attract higher levels of mineral exploration and mining activity, but with clear ‘rules of the game’ around expectations for the development of downstream processing. This can be achieved through instruments including mining licensing conditions, royalties and ‘speedbumps’ on unprocessed exports. African countries need to raise public investment in geological surveys and mineral research.

Policies and industrial strategies for e-mobility and BESS are necessary. Unlike advanced economies, most African states lack the ‘deep fiscal pockets’ to subsidize the purchase of EVs. Electrification of transport, therefore, needs to focus on corridors (particularly for heavier vehicles) and hubs (for cars, and two and three wheelers).

African development banks have a fundamental role to play. They operate as patient sources of capital for longer-term projects. They can act as co-investors and secure offtake agreements. They also play a potentially important role in project ‘derisking’ and ensuring project development and execution stay on track. An important feedback loop in the context of the region’s often under-capitalized development banks is that revenues from mining royalties and levies could be channeled to build up the balance sheets of these banks and strengthen their ability to invest in green industrial diversification, including BMVCs.

The ideal path for BMVC integration would be a continental level strategy that consolidates demand for EVs and BESS on the one hand, and supply side instruments on the other (Lebdioui, 2024). However, the track record of progressing from statements of intent and high-level strategies to the implementation of regional integration programs has been weak (Cramer & Chisoro-Dube, 2021). Without discounting the possibility of meaningful multi-country BMVC strategies being designed and implemented, there is a premium on identifying ‘second-best’ (Rodrik, 2008), institutional arrangements and actors that might catalyze regional BMVC development.

A variety of leading or integrating actors could play a role. The African Continental Free Trade Area or AfCFTA secretariat can play an important role in articulating the need for member countries to develop individual and collective strategies to add value to battery minerals and build BMVCs in ways that are ambitious yet feasible.

Think tanks and research institutions can play a supportive role in establishing a grounded evidence base for the formulation of informed strategies and policies. This includes the analysis of global markets and value chains, tracking investment trends and trade flows, and identifying available policy options.

As outlined above, African development banks can play an important role in BMVC development at the national and regional levels. Beyond their obvious role of providing finance, these banks enjoy a privileged relationship with governments and can influence policy. They can co-invest with foreign investors, reducing market risk perceptions, and securing the supply of CMS for further processing through offtake agreements.

Industry-led initiatives, such as the African Association of Automotive Manufacturers, which aims to promote automotive assembly and component manufacturing, can act as potential catalysts by setting out feasible routes for BMVC value chain development.

Conclusion

Africa’s resource endowment of close to a third of the world’s proven reserves of CMs provides a potential platform for green industrialization, particularly through BMVC development. However, to realize this potential requires strategies to build the necessary industrial capabilities.

While China has established a formidable lead in BMVCs and other low carbon technologies, this does not preclude the possibility of African countries establishing a significant BMVC presence. Other developing countries illustrate that this is possible, such as the examples of Indonesia and Chile.

Developing upstream and midstream BMVC capabilities would add an order of magnitude greater value, raise much needed tax revenue and earn foreign exchange necessary to alleviate the balance of payments constraint to broader structural transformation. To the extent that it is feasible to add to this downstream assembly and deeper end use manufacturing for EV and BESS applications, the value chain could also make a significant direct contribution to employment.

The prevailing mode of BMVC integration is on a bilateral basis. This is predominantly through investment in CM mining and exports of unprocessed minerals by Chinese miners and Western transnational commodity traders and miners. African countries have more strategic and policy levers than they may perceive to take advantage of geopolitical contestation for access to CMs. This includes the ability to engage in ‘geopolitical auctions’ that favor the most developmental package of investment and value-addition and the strategic use of minerals policy instruments.

Considerably more challenging is to mobilize strategies that build multi-country BMVCs on the continent. While desirable, the prospects of a coherent and actionable continent-wide strategy appear remote. However, there does appear to be scope to develop sub-regional strategies, such as those in southern Africa.

References

Africa Investment Forum. (2023). Rich in green minerals, African countries eye booming electric vehicle and clean energy market worth trillions of dollars. Africa Investment Forum. https://www.africainvestmentforum.com/en/news/press-releases/rich-green-minerals-african-countries-eye-booming-electric-vehicle-and-clean

Africa Natural Resources Management and Investment Center (ANRC). (2022). Approach paper to guide preparation of an African green minerals strategy. African Development Bank. Abidjan, Côte d’Ivoire. https://www.afdb.org/sites/default/files/documents/publications/approach_paper_towards_preparation_of_an_african_green_minerals_strategy.pdf

African Head of State and Government (AHOS). (2023). The African leaders Nairobi declaration on climate change and call to action.

African Union. (2009). African mining vision. Retrieved August 30, 2023, from https://au.int/sites/default/files/documents/30995-doc-africa_mining_vision_english_1.pdf

Ahadjie, J., Kabanda, F., Nyirahuku, C., & Opoku, F. (2023). Strengthening Africa’s role in the battery and electric vehicle value chain. Africa Economic Brief, 14(7), African Development Bank Group. https://www.afdb.org/en/documents/strengthening-africas-role-battery-and-electric-vehicle-value-chain-volume-14-issue-7

Andreoni, A., & Roberts, S. (2022). Geopolitics of critical minerals in renewable energy supply chains: Assessing conditionalities on the use of technology, market capture, and the implications for Africa. The African Climate Foundation. Retrieved August 30, 2023, from https://africanclimatefoundation.org/wp-content/uploads/2022/09/800644-ACF-03_Geopolitics-of-critical-minerals-R_WEB.pdf

Banya, N. (2023). China’s Sinomine completes $300m Zimbabwe lithium projects. BusinessDay. https://www.businesslive.co.za/bd/companies/2023-07-10-chinas-sinomine-completes-300m-zimbabwe-lithium-projects/

Banya, N., & Chingono, N. (2023, November 30). Zimbabwe orders lithium miners to submit refinery plans by March 2024. Reuters. https://www.reuters.com/world/africa/zimbabwe-orders-lithium-miners-submit-refinery-plans-by-march-2024-2023-11-30/

Baskaran, G. (2022). Could Africa replace China as the world’s source of rare earth elements? Brookings. https://www.brookings.edu/articles/could-africa-replace-china-as-the-worlds-source-of-rare-earth-elements/

Burger, S. (2023, January 19). US, DRC, and Zambia sign MoU to strengthen EV battery value chain. Mining Weekly. https://www.miningweekly.com/article/us-drc-and-zambia-sign-mou-to-strengthen-ev-battery-value-chain-2023-01-19

BTR to invest in cathode plant in Morocco. (2024, January 2). Chemical Industry Digest, NA. https://link.gale.com/apps/doc/A777957487/AONE?u=unict&sid=bookmark-AONE&xid=8a85e105

Campbell, P., Dempsey, H., & Davies, C. (2023, August 24). The search for winners in the new battery era. The Financial Times. https://www.ft.com/content/34c6c191-a803-495a-938d-e1328d53d77c

CEIC Data. (n.d. a). Morocco motor vehicle production [Data set]. CEIC Data. https://www.ceicdata.com/en/indicator/morocco/motor-vehicle-production

CEIC Data. (n.d. b). South Africa motor vehicle production [Data set]. CEIC Data. https://www.ceicdata.com/en/indicator/south-africa/motor-vehicle-production

Chang, H., Hauge, J., & Irfan, M. (2016). Transformative industrial policy for Africa. United Nations Economic Commission for Africa. https://archive.uneca.org/publications/transformative-industrial-policy-africa#:~:text=It%20aims%20to%20serve%20as,development%20plans%20across%20the%20continent.

Cohen, A. (2023, December 28). Lithium: Price collapse secures green transition, causes headaches. Forbes. https://www.forbes.com/sites/arielcohen/2023/12/27/lithium-price-collapse-secures-green-transition-causes-headaches/

Cramer, C., & Chisoro-Dube, S. (2021). The industrialization of freshness and structural transformation in South African fruit exports. In Structural transformation in South Africa (pp. 120-142). Oxford University Press.

Creamer Media. (2023). Battery metals 2023: Powering the green economy [Report]. Creamer Media: South Africa. https://www.creamermedia.co.za/article/battery-metals-2023-powering-the-green-economy-2023-05-18

Dempsey, H. (2023, September 22). Chinese battery groups invest in Morocco to serve western markets. The Financial Times. https://www.ft.com/content/9539f746-82bf-49db-ae87-237196a60c88

Dempsey, H., Campbell, P., & Davies, C. (2023, August 14). Rival battery technologies race to dominate electric car market. The Financial Times. https://www.ft.com/content/67abc929-db1a-43c3-b03a-259a4316fd76

Department of Trade, Industry and Competition (DTIC). (2023). Electric vehicles [White paper]. Republic of South Africa. https://www.thedtic.gov.za/wp-content/uploads/EV-White-Paper.pdf

Electriqz. (2023, July 7). Key components of EVs: Your ultimate guide to electric cars. https://electriqz.com/key-components-of-evs-your-ultimate-guide-to-electric-cars/

Elijechtimi, A. (2024, May 15). China’s Hailiang, Shinzoom to build auto battery plants in Morocco. Reuters. https://www.reuters.com/business/autos-transportation/chinas-hailiang-shinzoom-build-auto-battery-plants-morocco-2024-05-15/

EMIS. (2024). The gold rush for green minerals: Unlocking Africa’s potential (An EMIS insights thematic report, Issue). https://www.emis.com/php/store/reports/AC/The_Gold_Rush_for_Green_Minerals:_Unlocking_Africa%E2%80%99s_Potential_en_810795516.html

Hedley, N. (2023, April 8). KZN-based Hulamin making ‘significant inroads’ as electric vehicle supplier. News24. https://www.news24.com/fin24/climate_future/environment/kzn-based-hulamin-making-significant-inroads-as-electric-vehicle-supplier-20230408

IEA. (2024). Batteries and secure energy transitions. IEA, Paris. https://www.iea.org/reports/batteries-and-secure-energy-transitions, Licence: CC BY 4.0

IEA. (2021). The cost of capital in clean energy transitions. IEA, Paris. https://www.iea.org/articles/the-cost-of-capital-in-clean-energy-transitions, Licence: CC BY 4.0

IMF. (2024). Digging for opportunity: Harnessing sub-Saharan Africa’s wealth in critical minerals. In Regional economic outlook: Sub-Saharan Africa—A tepid and pricey recovery. Washington, DC, April. https://www.imf.org/-/media/Files/Publications/REO/AFR/2024/April/English/MineralsNote.ashx

Lebdioui, A. (2024). Survival of the greenest: Economic transformation in a climate-conscious world. Cambridge University Press. https://doi.org/10.1017/9781009339414

Lopes, C. (2023). Priorities for an equitable reform of the global financial system: Unlocking climate investment and sustainable development in Africa. The Africa Climate Foundation. https://africanclimatefoundation.org/wp-content/uploads/2023/08/Whitepaper_final3.pdf

Karkare, P. (2024). Resource nationalism in the age of green industrialisation. ECDPM (Discussion paper No. 365, Issue). https://ecdpm.org/download_file/69655bf0-c1c4-4156-857f-c67fde07a66b/3885

Karkare, P., & Medinilla, A. (2023). Green industrialisation: Leveraging critical raw materials for an African battery value chain. ECDPM (Discussion paper No. 359).

Mantashe, G. (2024, May). Opening remarks by the honorable minister of mineral resources and energy, Mr. Gwede Mantashe (MP). Investing in African Mining Indaba. https://www.dmre.gov.za/news-room/post/2169/opening-remarks-by-the-honourable-minister-of-mineral-resources-and-energy-mr-gwede-mantashe-mp-investing-in-african-mining-indaba

Mckinsey & Company. (2024, January 10). Global energy perspective 2023: Hydrogen outlook. https://www.mckinsey.com/industries/oil-and-gas/our-insights/global-energy-perspective-2023-hydrogen-outlook

Rodrik, D. (2008). Second-best institutions. American Economic Review, 98(2), 100-104.

Soulé, F. (2023, August 21). What a U.S.-DRC-Zambia electric vehicle batteries deal reveals about the new U.S. approach toward Africa. Carnegie Endowment for International Peace. https://carnegieendowment.org/2023/08/21/what-u.s.-drc-zambia-electric-vehicle-batteries-deal-reveals-about-new-u.s.-approach-toward-africa-pub-90383

Tanchum, M. (2022). Morocco’s green mobility revolution: The geo-economic factors driving its rise as an electric vehicle manufacturing hub. Middle East Institute. https://www.mei.edu/sites/default/files/202208/Tanchum%20-%20Morocco%20Green%20Mobility%20Revolution.pdf

Trade & Industrial Policy Strategies (TIPS). (2021). Opportunities to develop Lithium-ion battery value chain in South Africa [Report]. Low Carbon Transport – South Africa (LCT-SA) Project. https://tips.org.za/projects/past-projects/sustainable-growth/climate-change/item/4012-opportunities-to-development-the-lithium-ion-battery-value-chain-in-south-africa

Venditti, B. (2022). Visualizing China’s dominance in clean energy metals. Elements: Visual Capitalist. https://elements.visualcapitalist.com/visualizing-chinas-dominance-in-clean-energy-metals/

Visual Capitalist. (2024, January 9). Chart: The $400 billion lithium battery value chain. https://elements.visualcapitalist.com/lithium-battery-value-chain/

White, E., Davies, C., McMorrow, R., & Dempsey, H. (2023, August 28). Can anyone challenge China’s EV battery dominance? The Financial Times. https://www.ft.com/content/1f95d204-ea6a-4cf3-b66a-952362e8092a

Wuttke, T. (2022). The automotive industry in developing countries and its contribution to economic development. Centre of African Economies Working Paper 2021:2. Roskilde University, Denmark.