Introduction

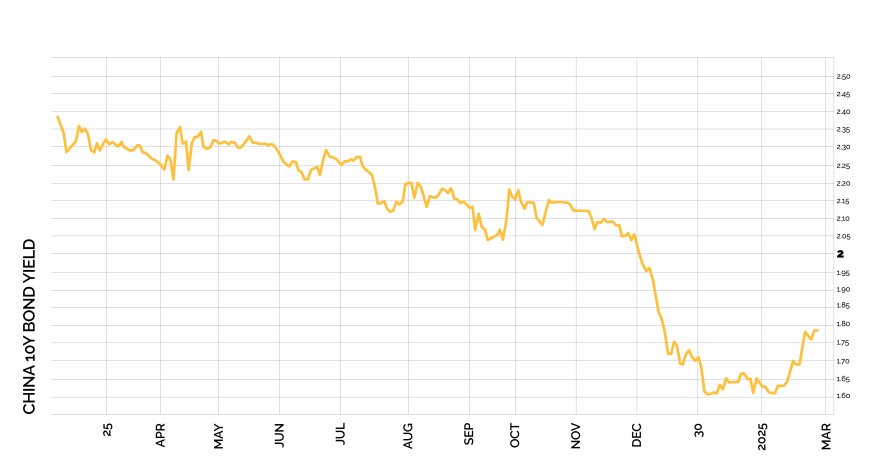

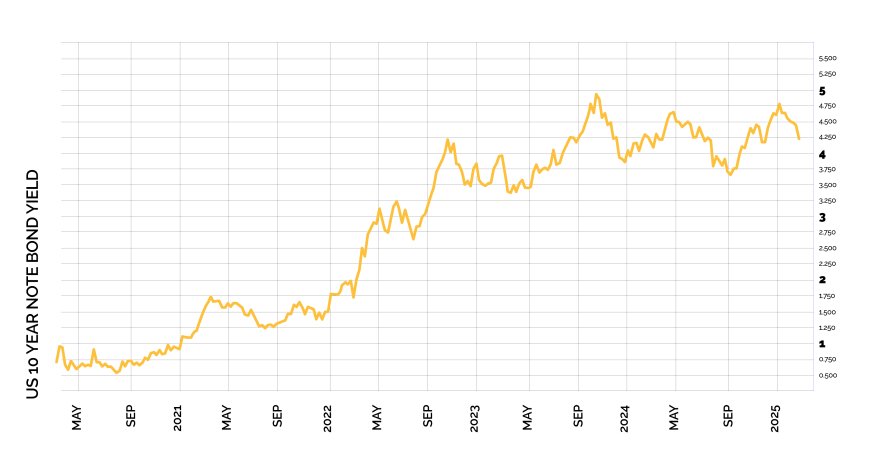

As we step into 2025, the global economic landscape is defined by two starkly divergent realities. On one hand, the United States is contending with inflation and high treasury yields, signs of economic resilience and a harbinger of costly financial tightening, while China finds itself mired in deflation, with record-low government bond yields, reminiscent of Japan’s “lost decades”. Unlike the coordinated multilateral efforts of the 1985 Plaza Accord, today’s fragmented geopolitical landscape offers no clear mechanism to address these imbalances.

Source: TradingEconomics.com

Source: TradingEconomics.com

Could China turn this situation to its advantage? This article examines the potential of a “ElectroYuan” as both a financial and geopolitical lever. Such an initiative could counteract China's deflationary spiral while redefining global trade and finance. For emerging markets like those in Africa, yuan-denominated financing could offer lower borrowing costs, currency stability, and integration into China’s green manufacturing ecosystems, offering a strategic alternative to current dollar-dependent energy and transportation sectors in countries in the global south.

This article explores the potential of the ElectroYuan to emerge as the petrodollar of the energy transition, reshaping global economic dynamics while offering both strategic opportunities and risks for the Global South.

A Green Manufacturing Powerhouse

China leads the world in green technologies, producing over 70% of the world’s solar panels and dominating in wind turbines and Electric Vehicles (EV) markets. The Belt and Road Initiative (BRI) could further solidify China’s position as a global leader in green development, leveraging its Green Investment Principles (GIP) to finance sustainable infrastructure projects across the Global South, while reducing dollar exposure. Between 2013 and 2022, China mobilized US$44.92 billion in climate finance for developing countries, accounting for 6.1% of global climate finance from developed nations, World Resources Institute (WRI).

This positions China as a key player in green transition, particularly in high-demand regions like Southeast Asia and the Pacific.

By tying green exports to financial incentives, China could establish a system reminiscent of the petrodollar system for a decarbonised world. However, this growing influence has raised concerns in the US and Europe over dependency on Chinese clean energy technologies, prompting policies aimed at "de-risking" and strengthening local supply chains.

The ElectroYuan: Anchoring the Energy Transition

The ElectroYuan could position the yuan as the dominant currency for green finance addressing both global sustainability needs and China’s economic priorities.

ElectroYuan Key Strategic Levers:

- Trade and Currency Integration: Promoting yuan transactions in green exports, with central bank currency swaps and engagements with continental or regional Development Financial Institutions (DFIs) – such as African Development Bank (AfDB)– to facilitate transactions.

- Green Bond Market Expansion: Strengthening China’s ability to offer cost-effective, yuan-based financing for renewable energy projects in emerging markets (with even lower interest rates and long-term repayment stability).

- Deflation Advantage: A weakening yuan makes yuan-based loans more attractive by reducing international repayment burdens compared to the dollar-dominated alternatives.

Through these potential mechanisms, the ElectroYuan could drive China’s domestic economy while paving the way for a sustainable global financial framework.

Turning Deflation into Opportunity

China’s current economic challenges can be mitigated by green technology exports offer a pathway to stability and growth via the following mechanisms:

- Surplus Capacity Absorption: Offsetting over-production in green technology sectors, capitalising on ongoing price declines.

- Revenue Generation: Injecting liquidity into China’s economy through earnings from green exports and global trade through infrastructure projects or consumer financing

- Employment Support: Sustaining industrial jobs, important contributing to social and economic stability.

Geopolitical Repercussions

This ElectroYuan has far-reaching geopolitical implications, redefining alliances and fostering new economic interdependencies.

A. Opportunities for Influence:

- Empowering the Global South: Yuan-based financing could offer countries in Africa, Asia, and Latin America a lower-cost alternative to dollar-denominated loans, with integrated access to Chinese technology.

- Strengthening Economic Ties: Adoption of the ElectroYuan could deepen trade and financial interdependence between China and recipient countries, fostering mutual benefits while enabling technology and knowledge transfer across manufacturing value chains.

B. Risks of Overreach:

- Supply Chain Vulnerabilities: Overdependence on Chinese green technologies could create supply chain disruptions and geopolitical risks.

- Intensified Competition: The US and the EU are actively implementing policies to diversify green supply chains such as the US Inflation Reduction Act (US-IRA) and the EU Green Deal (EU-GD), a reflection of an escalating race to secure green innovation and resources.

Moving forward, China must strategically balance its pursuit of global leadership with the risks of geopolitical backlash.

Lessons from the Petrodollar and the Plaza Accord

The petrodollar sustained the US economy while reinforcing global dependencies. Similarly, the 1985 Plaza Accord realigned currencies to ease trade imbalances. Unlike Japan, China is not bound by Western alliances; instead, this ElectroYuan positions it as a self-reliant force in global finance.

Key Reflections:

- Trust & Transparency: Unlike the US dollar, the yuan lacks global trust as a reserve currency. Additionally, there are concerns over the transparency of China's climate finance framework and the environmental and social impact of its projects. Success of the ElectroYuan requires policy stability, institutional reliability, and transparent financial systems.

- Expanding its Sphere of Influence: While Japan’s US-aligned economic policies, China’s approach priorities its self-interest and Global South partnerships, positioning the ElectroYuan to build a multipolar financial system.

- Sustainability as a Foundation: The ElectroYuan’s strategic value lies in its alignment with global decarbonisation goals, reduction of CAPEX cost of green technology, and reducing the reliance of dollar-priced hydrocarbons.

China’s ability to successfully manage these challenges while avoiding geopolitical friction will define the ElectroYuan’s impact on global financial and trade.

A Call to the Global South

The ElectroYuan could redefine the global financial landscape for the Global South, offering:

- Affordable Financing: Yuan-denominated loans with reduced currency risks, supporting sustainable infrastructure development.

- Economic & Environmental Opportunities: Access to China’s green technologies for long-term development.

- Strategic Financial Autonomy: Diversified financing options to strengthen nations’ negotiation power and reduce reliance on traditional systems.

However, nations must balance short-term gains with long-term independence, avoiding overreliance on any single financial partner.

Conclusion: Shaping the Future

This ElectroYuan represents a transformative vision for the global economy, blending green technology leadership with financial innovation. By turning domestic challenges into global opportunities, China could redefine the rules of trade and finance.

For the Global South, it presents both opportunities and risks, with the potential to drive equitable growth or reinforce economic reliance.

As green technologies become central to global influence, the ElectroYuan could usher in a new era of both cooperation and competition.

About the Author

Ebipere K. Clark

Ebipere K. Clark is a seasoned consultant specialising in capital markets, energy and infrastructure sectors, climate action policy and finance. He is the Managing Partner at Frontier-Alpha LLP and has held key advisory roles, including Special Adviser to the Governor of the Central Bank of Nigeria and Technical Adviser to the CEO of the Infrastructure Corporation of Nigeria (InfraCorp).